Local drillers see shares tumble as oil price drops

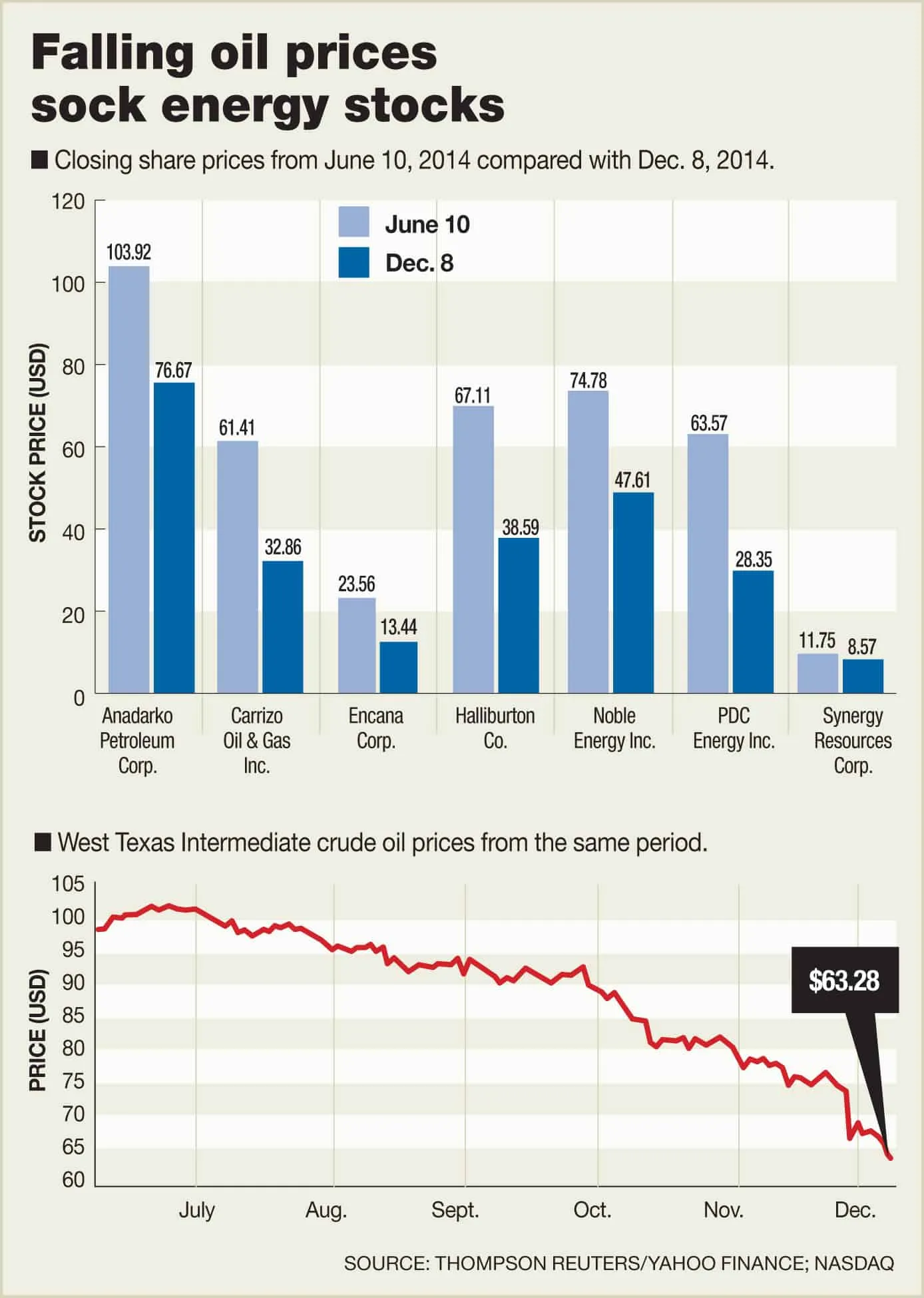

GREELEY — Stocks of companies that operate in Northern Colorado have plummeted with falling oil prices, potentially leading to decreased capital spending next year.

PDC Energy Inc. (Nasdaq: PDCE), which drills oil wells in Weld County, posted among the steepest declines. Company shares sank to a 52-week low of $27.91 in December after reaching a high of $70.44 in June, a 60 percent decline in six months.

Oil prices began falling from around $100 per barrel in July to $67 in December after OPEC said it would not cut production. Energy stocks, meanwhile, have fallen with the…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!