Commercial Solar is a big investment, but not an overwhelming one

Solar offers a significant economic benefit for commercial property owners while also positively impacting the environment and offering a path to compliance for new municipal requirements like Energize Denver. A local, experienced solar installer will help you navigate the complexities of commercial solar to achieve financial success for your project.

Colorado C-PACE Program

The Colorado C-PACE program helps building owners complete energy efficiency and renewable energy improvement projects with terms up to 25 years. This private form of non-recourse financing is tied to the property via a special tax assessment facilitated by the county, so it transfers to the next owner if the property is sold. Because the debt is repaid on property taxes, this financing vehicle is particularly advantageous for NNN leases whereby the tenant uses a portion of their utility savings from solar to pay the C-PACE note.

The Colorado Clean Energy Fund

The Colorado Clean Energy Fund (CCEF) is a nonprofit investment fund offering loan products that support access to clean energy for individuals and businesses in Colorado. Some of the financing options they offer for commercial properties include the Energy Project Accelerator Loan (Energy PAL), Clean Conversion Loan, and Bridge Loan. Taking advantage of these products will enable you to improve your building’s efficiency, reduce utility expenses, and keep up with market demand for more green buildings.

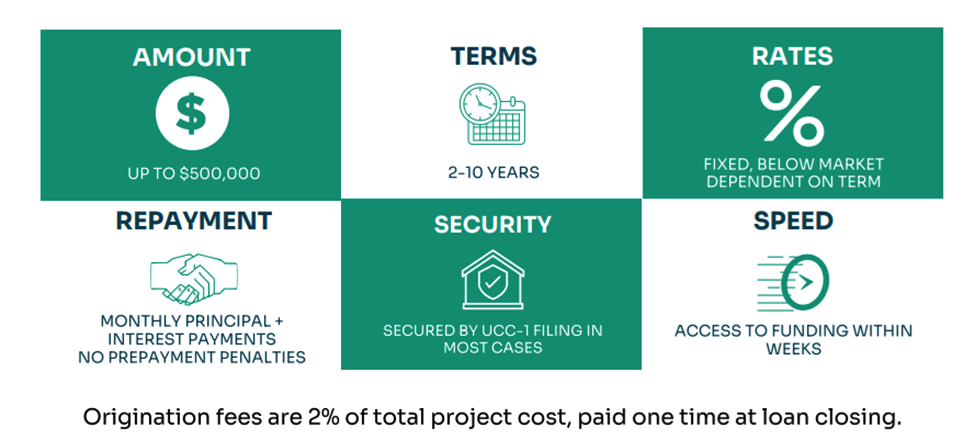

ENERGY PAL

Energy PAL is a short-term loan program that closes financing gaps for smaller projects that are otherwise difficult to finance. Businesses and tax-exempt organizations can leverage up to $500,000 with fixed rates and terms between 2-10 years. Access to funding is quick, and the loan is secured via a filing on the equipment instead of a lien on the property.

CLEAN CONVERSION LOAN

The Clean Conversion product offers longer terms up to 15 years and up to $1,000,000 in funding. It can be a flexible alternative to C-PACE given it’s secured by a subordinate lien on the property.

BRIDGE LOAN

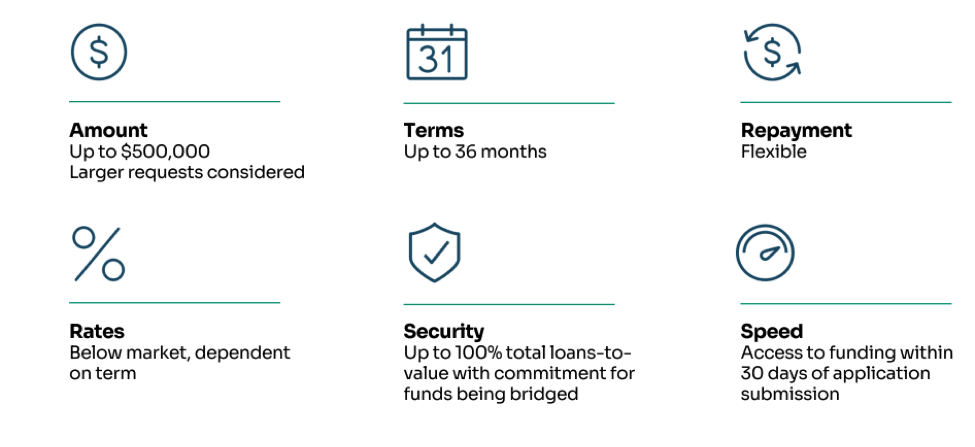

The Bridge Loan covers any out-of-pocket expenses that may be required while an owner awaits grant funding, the tax credit, or any gap on timing from other funding sources.

Commercial Solar is a Big Investment, But Not an Overwhelming One

Overall, you have quite a few options to finance your commercial solar project. Solar is a great way to earn a return, make a positive environmental impact, and differentiate your business just by taking advantage of your unused rooftop.

Image source: cocleanenergyfund.com

Image source: cocleanenergyfund.com

Image source: cocleanenergyfund.com

Alicia Creighton is a commercial solar project developer at Namaste Solar. Namaste Solar’s purpose is to transform energy and transform business. The company’s experienced solar developers will help you understand your project goals, timelines, and milestones. Verify their extensive commercial experience.

Alicia.Creighton@namastesolar.com

Solar offers a significant economic benefit for commercial property owners while also positively impacting the environment and offering a path to compliance for new municipal requirements like Energize Denver. A local, experienced solar installer will help you navigate the complexities of commercial solar to achieve financial success for your project.