Dodd-Frank rollback benefits community banks

Banks in Colorado, especially smaller ones, won’t have to jump through as many regulatory hoops thanks to Congress rolling back some portions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was originally passed by the Obama administration in 2010 in response to the financial crisis.

Banks in Colorado, especially smaller ones, won’t have to jump through as many regulatory hoops thanks to Congress rolling back some portions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was originally passed by the Obama administration in 2010 in response to the financial crisis.

One of the provisions of Dodd-Frank required banks with $10 billion in assets to conduct company-run stress tests every year to make sure they could handle major downturns in the market and still remain solvent. The banking industry had railed against the provisions for years, claiming they stifled smaller banks’ ability to make certain types of loans and cost them money conducting stress tests that don’t really apply to banks their size.

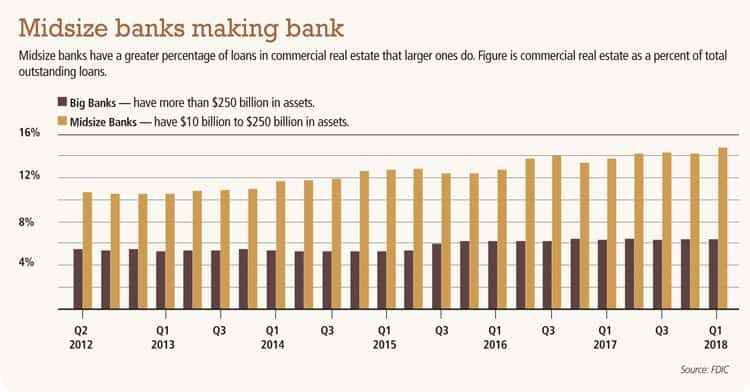

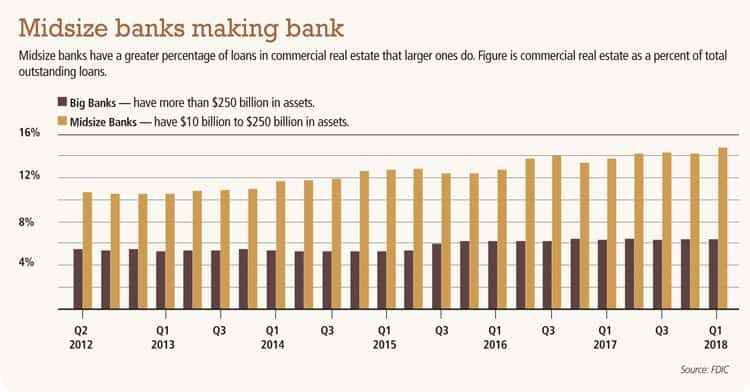

Senate Bill 2155 amended the Financial Stability Act of 2010 to increase the asset threshold at which company-run stress tests are required from $10 billion to $250 billion. It also increased the asset threshold for mandatory risk committees from $10 billion to $50 billion. The bulk of Colorado’s 142 banks no longer have to comply with the stress test provision, said Don Childears, president and CEO of the Colorado Bankers Association. “It does allow the feds to reach down into smaller banks and say we think there is some risk you have so we will require you, individual bank, to run stress tests. That’s the safety factor in this.”

What that means in Colorado is that only a handful of banks that operate in the state are over that $250 billion mark, including Wells Fargo, Chase Bank and U.S. Bancorp. And all of those are large national banks.

Banks that fall below that $250 billion threshold no longer have to run stress tests that “didn’t produce meaningful results for banks and didn’t protect the financial system because these are not significant financial institutions,” Childears said. “The design of the stress test was to focus on SIFI, significantly important financial institutions. In the process they got carried away and applied it to everyone. The risk to the whole system is in the larger banks.”

Regulators would come up with extreme scenarios about interest rates going through the ceiling, a runoff off customers and a decline in asset values all happening simultaneously and it was the bank’s job to run computer modeling to see if their institution could survive the stresses described in the test.

“These are smaller banks. They already know what their strengths are and what their risks are. They didn’t really benefit from these stress tests and the system didn’t benefit. That is why it made sense to remove the requirement that they run them. It was make work: work that was mandated but didn’t produce value,” he said.

The Colorado Bankers Association followed 16 Dodd-Frank provisions closely, although the Senate Bill that ultimately passed included more than just those provisions.

The most important is the portfolio exception. Under the current qualified mortgage and ability to repay rules, even if a bank gave a home loan and never passed it on to a secondary mortgage company, it would not be able to make loans to low-income individuals “who were basically cut off from lending because the government said they had to have a certain income before we could lend to them,” Childears said. Under the new rules, if a bank is giving a loan and keeping it in its portfolio, it can make loans to whoever it wants because it, and it alone, is shouldering the risk that the loan won’t be repaid. This provision hit rural populations, the recently retired and small businesses fairly hard.

“This really is focused on regulatory relief for community banks and, in fact, not really relief for the banks themselves but for their customers,” he added. “The rules have now been rolled back, or softened, for most banks. Regretfully, from the excessive regulation that came out of Dodd-Frank, banks could not effectively lend to certain kinds of customers they lended to for years, good credit-worthy customers, but the government decided in its wisdom they weren’t as deserving of credit. We think that was wrong.”

Another provision provides relief for mortgages under $400,000, which Childears points out is the bulk of home mortgages. If you can’t find an appraiser to do the home appraisal in a certain time frame you don’t need to have an appraisal done on smaller mortgage loans. The bank is qualified to value the property.

Banks still prefer appraisals, Childears said, but there were situations in the past where a mortgage loan approval was delayed for weeks and weeks because an appraiser wasn’t available so the borrower couldn’t close on a property and subsequently lost out on the property.

Gerard Nalezny, chairman of Verus Bank of Commerce in Fort Collins, said the tendency in the industry is to look at Dodd-Frank as the primary banking regulation, but “really there’s a variety of different laws and regulations and regimes related to regulating banks.”

There have been executive and legislative actions recently that deal with banking regulations, but the trend seems to be moving toward less regulation and fewer restrictions on the industry as a whole.

“Some of what you found is a lot of Dodd-Frank didn’t apply to smaller community banks but the tendency was to trickle down. We see less of that going forward, which we’d view as a positive,” Nalezny said.

He said that at the end of the day, the “regulatory regime is put in place to encourage safe and sound banking practices and from that standpoint, that doesn’t change.”

Banks in Colorado, especially smaller ones, won’t have to jump through as many regulatory hoops thanks to Congress rolling back some portions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was originally passed by the Obama administration in 2010 in response to the financial crisis.

Banks in Colorado, especially smaller ones, won’t have to jump through as many regulatory hoops thanks to Congress rolling back some portions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was originally passed by the Obama administration in 2010 in response to the financial crisis.

One of the provisions of Dodd-Frank required banks with $10 billion in assets to conduct company-run stress tests every year to make sure they could handle major downturns in the market and still remain solvent. The banking industry had railed…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!