Commercial market stable — but some tremors felt

Vacancies low, lease rates climb, but problems exist

There was a time that real-estate agents, particularly in commercial properties, never mentioned Boulder, Broomfield, Larimer and Weld counties in the same breath. Twenty years ago, Boulder/Broomfield and Larimer/Weld were so far divergent in location, economic factors and the job talent pool that to factor them together would be utter nonsense.

There was a time that real-estate agents, particularly in commercial properties, never mentioned Boulder, Broomfield, Larimer and Weld counties in the same breath. Twenty years ago, Boulder/Broomfield and Larimer/Weld were so far divergent in location, economic factors and the job talent pool that to factor them together would be utter nonsense.

Apparently, that is no longer the case.

“The Larimer and Weld counties influence over what happens in Boulder County has increased,” said Steve Kawulok, managing director for SVN /Denver Commercial LLC. “I think we’re maturing into a more nationally known marketplace. It’s more the macro environment that’s doing the driving.”

Part of that is that overall commercial markets are tightening across Northern Colorado, though there are a few odd quirks in the picture. Even in Weld County, where commercial rates are challenged by a weak energy market, aspects of the commercial real estate markets have reached new records.

SPONSORED CONTENT

While commercial brokers typically track lease and vacancy rates by sector — i.e, office, retail, industrial, etc. — what do the markets look like if you blend those rates together?

Over the last five years, Boulder County commercial lease rates — office, retail, industrial and research and development flex — have increased from approximately $10.50 per square foot five years ago to a little over $14 today, according to SVN data. Vacancy has dropped in Boulder County from 10.5 percent to 6.5 percent over the last five years.

Larimer County is not far behind, Kawulok said, with that blended lease rate increasing from $10 per square foot to about $12 per square foot. Vacancy dropped during this same time from around 9.5 percent to 6 percent, he said.

While Weld County rates have always been a bit cheaper, leasing rates have also increased, despite the downturn in the energy sector, jumping from $8 per square foot to about $9.50.

“Vacancy dropped during this five-year period from about 10 percent to just about 4 percent,” Kawulok said. “Weld has the lowest vacancy rate, though negative energy industry impacts are starting to be felt, and the vacancy rate will probably trend up a few points this quarter.”

Julius Tabert, a vice president with CBRE in Fort Collins, agreed that the Northern Colorado market has grown more interconnected, but the commercial market expert did not believe that the energy market was having a profound effect on the Weld County industrial market. CBRE data had the Fort Collins industrial vacancy rate at 2.6 percent, Loveland at 13.1 percent and Greeley at 4.5 percent.

“Incredibly, the oil and gas industry didn’t vacate, they just did not continue to move into the market,” Tabert said. He said there has been one significant tenant loss, an oil-and-gas piping company that left a 160,000-square-foot building in Johnstown, though the area may have lost a few small contractors.

“Generally, you can see it’s tight all around, especially in Fort Collins just because we don’t have as much product available,” Tabert said. “New construction production is slowing down, because if you build it today, you are basically required to ask for a $12 lease rate.

“Considering a few years back we were at $6 per square foot lease rate, it’s taking quite a bit of time to fill up those buildings. It is overall quite a jump, and I think that drives people to be more efficient with their space.”

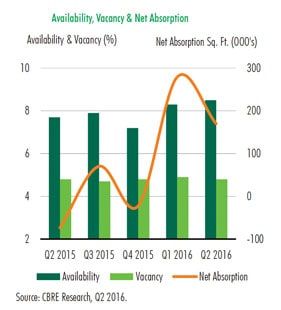

Northern Colorado’s office market, including both Larimer and Weld counties, was incredibly strong, according to CBRE data.

Northern Colorado’s office market continued to show notable strength through the first six months of 2016,” notes a CBRE report. “Positive net absorption of 155,055 sq. ft. pushed vacancy to 4.8% as of Q2 2016, an all-time low.”

Boulder’s perennially strong downtown office has continued to see problems due to the loss of some large technology companies, including SendGrid. While all of Boulder still showed a strong 5.7 percent vacancy rate at the end of the second quarter, looming subleases have started to bring down office-space pricing, said Jason Kruse, managing broker for The Colorado Group

“That’s still an issue. I just know that the attitude of the landlords has changed,” Kruse said. “They’ve gone from naming their price, to getting things done.”

Across Boulder County, the industrial market has remained strong, with a direct vacancy rate of 3.3 percent and an availability rate of 4.2 percent, according to CBRE data. Broomfield-only data was unavailable, but the northwest Denver metropolitan market was running about 10 percent direct vacancy for industrial property, office about 11 percent and retail at 3.3 percent.

“The commercial real estate market is stable right now, but there are tremors — the economy and the election, Kruse said. “It’s not like we’re going off a cliff, or up a ladder.”

Kruse also agreed that the Northern Colorado market is more integrated, though he believes companies are still hesitant, for instance, to move from Boulder to Fort Collins.

“Really, I think they might look 20 to 30 miles away, and maybe more like 10 to 20,” Kruse said. “But there is definitely a lack of supply in properties for sale, but I think that’s true in the whole state.”

Kawulok was slightly more enthusiastic, especially about the Fort Collins area.

“Our technology side is getting stronger, partly because we have the talent pool to support it,” he said. “Companies are more inclined to include us in their (national) searches.

The talent pool, quality of life and Colorado State University, which has now broken into the top 150 research institutions in the nation, have all contributed to the rise of Northern Colorado, Kawulok said. He believes this is not going to stop any time soon.

“If you only have local capital, you have to cap off at some point,” he said. “When capital comes in from around the nation, that is no longer the case.”

There was a time that real-estate agents, particularly in commercial properties, never mentioned Boulder, Broomfield, Larimer and Weld counties in the same breath. Twenty years ago, Boulder/Broomfield and Larimer/Weld were so far divergent in location, economic factors and the job talent pool that to factor them together would be utter nonsense.

There was a time that real-estate agents, particularly in commercial properties, never mentioned Boulder, Broomfield, Larimer and Weld counties in the same breath. Twenty years ago, Boulder/Broomfield and Larimer/Weld were so far divergent in location, economic factors and the job talent pool that to factor them together would be utter nonsense.

Apparently, that is no longer the case.

“The Larimer and Weld counties influence over what happens in Boulder County has increased,” said Steve Kawulok, managing director for SVN /Denver Commercial LLC. “I think we’re maturing…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!