Commercial real estate market heats up

Vacancies decline for office, retail, industrial sectors

Declining vacancies for commercial real estate are increasing competition for space, driving up lease rates and heating up the investment market throughout the Boulder Valley and Northern Colorado.

Office, industrial and retail buildings are seeing higher occupancies and rapid sales activity to rival the region’s red-hot housing market.

With few exceptions, meeting client needs in commercial real estate is almost impossible in some markets, and new construction is flagging even more than in residential construction.

SPONSORED CONTENT

“Lease rates are going up for sure,” said Jason Kruse, managing broker and principal with The Colorado Group Inc. of Boulder. “In downtown Boulder, the vacancy rate is less than 5 percent. Premium prices (for high-end properties) are in the mid-to high $30s, ranging from $32 to $38 (triple-net price per square foot annually).

“The sales market in all (Boulder County) cities right now is extremely hot. Properties are selling within days of being listed,” Kruse said. “There just is not a lot of supply; I would say the sales market is just as hot as the lease market.”

While just a few days in front of results for the second quarter, real estate agents said the first quarter was getting about as tight as it can get.

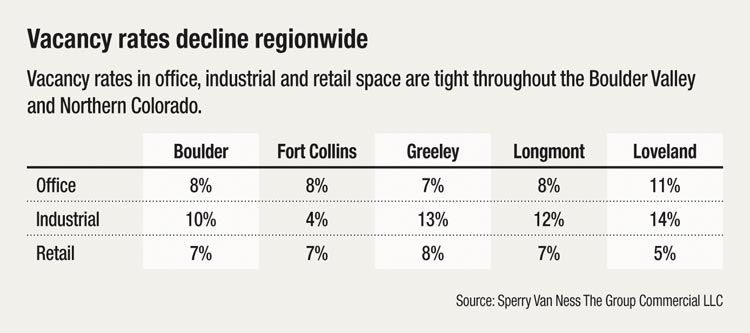

According to information from Sperry Van Ness –The Group Commercial in Fort Collins, Boulder had a 10 percent vacancy rate in industrial, a 7 percent vacancy rate in retail and an 8 percent vacancy rate in office.

In Fort Collins, those numbers were 4 percent in industrial, 7 percent in retail and 8 percent in office; Greeley saw a 13 percent vacancy in industrial, 8 percent in retail and 7 percent in office; Longmont, 12 percent in industrial, 7 percent in retail and 8 percent in office; and Loveland 14 percent in industrial, 5 percent in retail and 11 percent in office.

Agents said those numbers would tighten significantly after June 30, and even as of March were a little misleading, noted Nathan Klein, a partner in Loveland Commercial LLC.

In Loveland, the former Hewlett-Packard Co. site accounts for 800,000 square feet of commercial space, almost all of it industrial, which is largely unusable for 99 percent of potential clients.

“We sort of ignore that facility. It is real vacancy, but it doesn’t impact anything else in Loveland,” Klein said. Industrial spaces in Loveland that most clients are looking for, between 2,000 to 3,000 square feet, are almost nonexistent.

“You are literally going to count on one hand the search result,” Klein said. “And they are going to be extraordinary for one reason or another.

“Commercial space, especially in retail and small industrial space, almost doesn’t exist in Loveland,” he said.

Downtown Loveland is a lot more varied than Boulder, with a variety of non-updated property, mixed with anchored shopping malls and new retail. Rents vary from anywhere to $6 to $18, triple net – meaning minus expenses such as taxes and utilities – which might drive rates to somewhere in the range of $9 to $24 gross.

“The biggest thing right now, is there has been no real meaningful construction since really 2006 in this market,” Klein said. “The bottom line is, we’re going to have to see continued increase in lease rates until it makes it profitable to build again.”

Longmont probably has the most balanced market in the northern Front Range, with an overall commercial vacancy at about 14 percent, according to data from the Longmont Area Economic Council. Generally, vacancy rates are expected to range between 10 percent and 14 percent.

While the leasing market in downtown Boulder is exceptionally tight, Kruse thought the retail market across the Boulder core was probably a more acceptable 10 percent.

Another university town, Fort Collins, also was showing tight vacancy rates. The 7 percent rate in retail was translating to leases largely around $25 per square foot, gross, said Jerry Chilson, senior adviser with Sperry Van Ness. Newer retail space was going for slightly higher, $27 to $29, and new commercial space was selling for about $240 per square foot.

“I’ve never seen it tighter,” said Chilson, who has sold commercial real estate in Fort Collins since 2001.

Back in Boulder, Kruse said things might be ready to skyrocket, given new downtown construction, such as redevelopment of the former Daily Camera site downtown and the advent of the new Google campus.

“The Google campus (near Pearl and 30th streets) should push the center of Boulder eastward,” Kruse said, “and you might just find that some business owners will decide “if Google doesn’t need to be downtown, than maybe I don’t, either,’ ”

In the short term, however, the real question will be how much the new downtown buildings will be able to command in terms of rents.

“It will be interesting to see what kind of lease rates they will have, and how much demand there will be,” Kruse said. “If they are successful, you will likely see everyone else follow.”

Declining vacancies for commercial real estate are increasing competition for space, driving up lease rates and heating up the investment market throughout the Boulder Valley and Northern Colorado.

Office, industrial and retail buildings are seeing higher occupancies and rapid sales activity to rival the region’s red-hot housing market.

With few exceptions, meeting client needs in commercial real estate is almost impossible in some markets, and new construction is flagging even more than in residential construction.

“Lease rates are going up for sure,” said Jason Kruse, managing broker and principal with The Colorado Group Inc. of Boulder. “In downtown Boulder,…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!