Listings down; Jan. housing sales trail 2015 pace

There are some predictions we’d rather not see come true. But after the first month of 2016, it appears that our expectations about the availability of housing supply across Northern Colorado are quickly taking shape.

As we forecast, active listings at the end of January were down from the same time last year by 10.12 percent — from 3,591 to 3,228 — and a tight supply is creating consequences.

With fewer homes to choose from, it’s difficult for buyers to find the right properties. As a result, total housing sales essentially are flat compared with last year’s pace, up by less than 1 percent from January 2015 to January 2016. However, the lack of sales growth is not because of lack of demand but lack of supply.

Because demand is outstripping supply, prices are continuing to trend up. Even with the number of sales being flat, the total dollar volume is up 5.6 percent over January 2015. And average prices across the region are up 4.9 percent from a year ago to $304,977.

We should note that January also included a dose of good news for would-be homebuyers, in the form of favorable interest rates. In part because of the early struggles of the stock market and international economic concerns, mortgage rates have actually come down since the end of the year – contrary to the predictions of most economists. In fact, the chief economist for the National Association of Realtors, who once forecast the 30-year fixed mortgage rate to reach 5 percent by the end of 2016, has lowered that prediction to 4.5 percent.

We can take that as a positive sign for housing affordability, since each additional percentage point in interest rates cuts purchasing power by 10 percent.

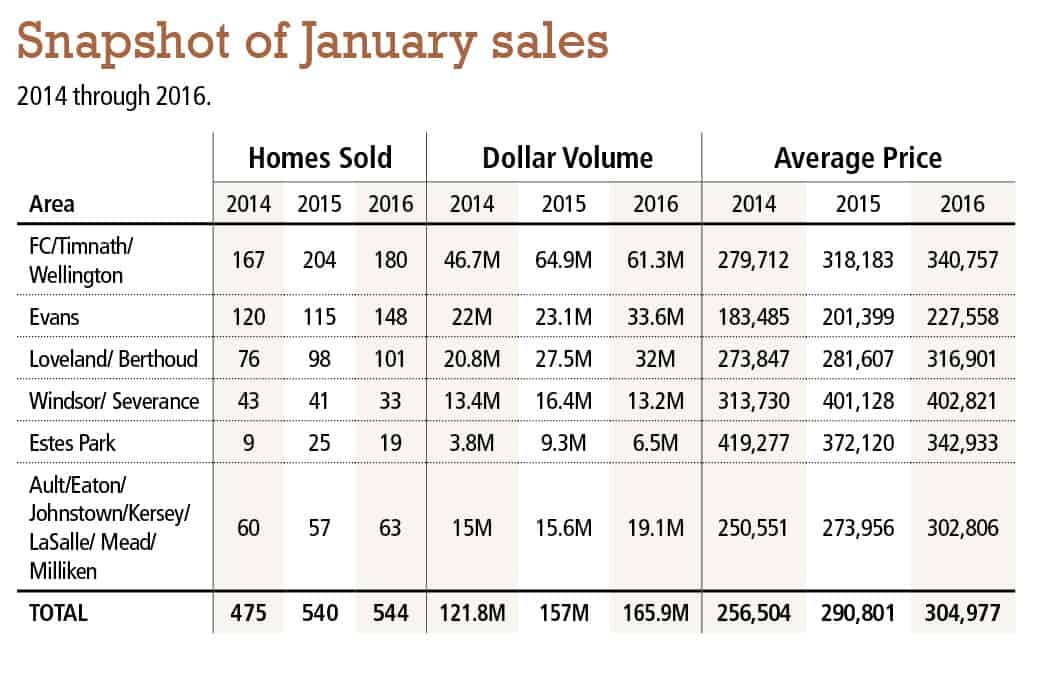

Meanwhile, here’s a closer look at January results for the submarkets that make up the Northern Colorado region:

Fort Collins/Wellington/Timnath: The largest submarket has been the most affected by the decline in listings. Sales in January totaled 180, down 11.8 percent from January 2015. At the same time, average prices are up 7.1 percent.

Greeley/Evans: The only market in the region that recorded significant sales gains from a year ago, with closings up 28.7 percent to 148. Average prices climbed 13 percent from January 2015, reaching $227,558.

Loveland/Berthoud: This market may be best reflective of the region overall, with a slight 3 percent increase in sales from last January — a total of 101 for the month. But average prices, on the other hand, were up 12.5 percent.

Windsor/Severance: Starting out as it finished off last year, Windsor/Severance features the highest average price in the region at $402,821 in January, up about 0.5 percent over last year. Total sales for the month slipped to 33, down 19.5 percent.

Estes Park: With a smaller statistical sample, year-over-year changes in Estes Park are bound to be more dramatic. January experienced a 24 percent decline in sales, down to 19, while average prices were off 7.8 percent.

Ault/Eaton/Johnstown/Kersey/La Salle/Mead/Milliken: Collectively, Weld County’s outlying communities registered 63 sales in January, up 10.5 percent, while average prices also increased 10.5 percent.

Larry Kendall co-founded associate-owned The Group Inc. Real Estate in 1976 and is creator of Ninja Selling. Contact him at 970-229-0700 or thegroupinc.com.

There are some predictions we’d rather not see come true. But after the first month of 2016, it appears that our expectations about the availability of housing supply across Northern Colorado are quickly taking shape.

As we forecast, active listings at the end of January were down from the same time last year by 10.12 percent — from 3,591 to 3,228 — and a tight supply is creating consequences.

With fewer homes to choose from, it’s difficult for buyers to find the right properties. As a result, total housing sales essentially are flat compared with…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!