Oil, gas companies drill deeper into debt

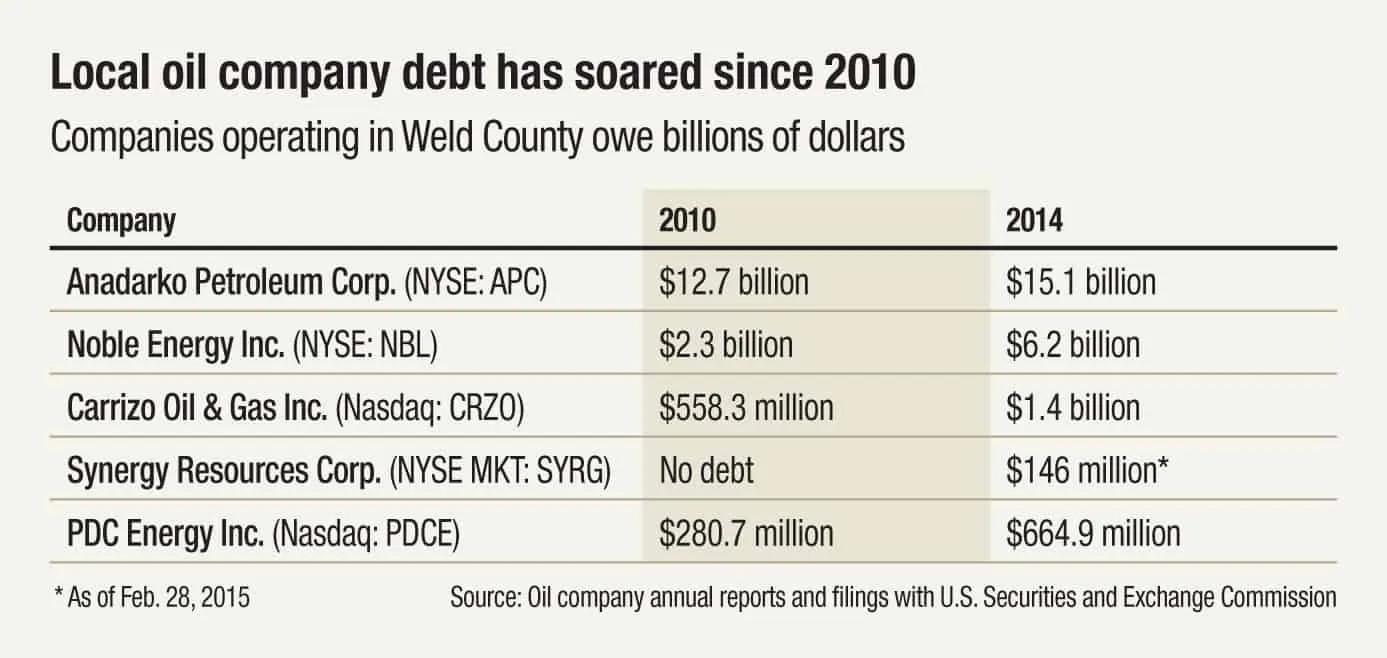

Oil and natural-gas company Anadarko Petroleum Corp., Weld County’s No. 1 oil producer, also takes the top spot in another category: its total long-term debt.

Anadarko (NYSE: APC), a company based in The Woodlands, Texas, that drills oil and natural-gas wells in Weld, accumulated $15.1 billion in debt by the end of last year from $12.7 billion just four years earlier.

Debt loads at major producers in Northern Colorado, along with those nationwide, have soared during the past five years, raising concerns about a prolonged price drop for oil and the effect on local economies should…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!