A mixed experience: Startups tell different stories about access to capital

Finding financing for entrepreneurial projects has never been easy. There have always been more entrepreneurs looking for financing than there is financing in the state, mainly because Colorado is such an attractive place to be it attracts people with an entrepreneurial spirit.

Finding financing for entrepreneurial projects has never been easy. There have always been more entrepreneurs looking for financing than there is financing in the state, mainly because Colorado is such an attractive place to be it attracts people with an entrepreneurial spirit.

Toby Krout, executive director and co-founder of Boomtown Accelerators in Boulder, has been in the industry in Denver since 1994. He said that even back then, people complained about the lack of venture capital funding across the Front Range. He said that Colorado has “some amazing and incredible venture capitalists” but it is also very important to have a founder-friendly venture industry.

“There’s a lot of capital out there, more than we ever had before, but the way it gets deployed is vital and so I think that we’re really fortunate to be in Colorado which is a founder-friendly ecosystem and has some leadership in that space,” he said.

SPONSORED CONTENT

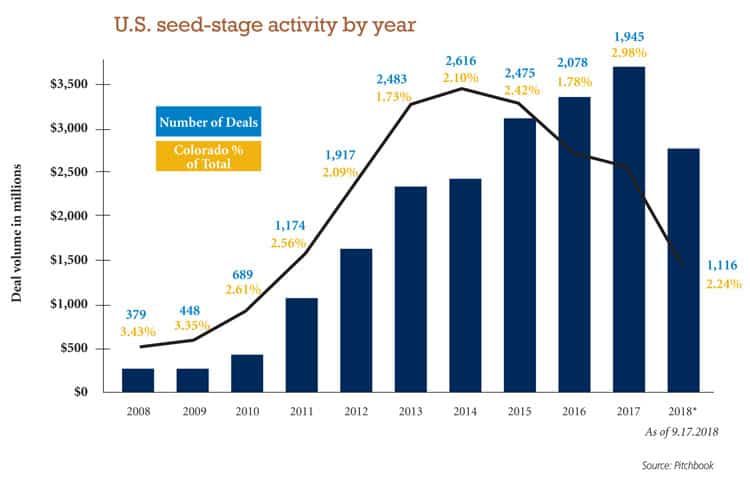

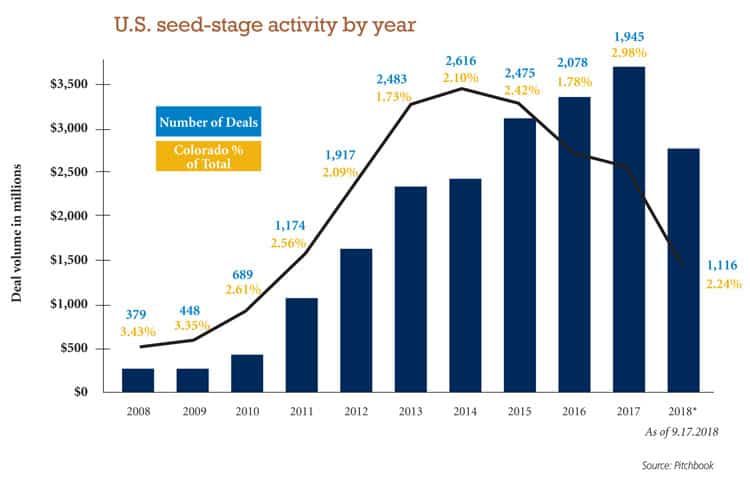

Data compiled by PitchBook, a national firm that tracks public and private equity markets, including venture capital, private equity and mergers and acquisitions, finds that nationally, there has been a steady rise in the amount of seed-stage activity since 2008, with $3.7 billion in funding in 2017. Colorado’s percentage of that funding was 2.98 percent. Back in 2008, Colorado’s percentage of $266 million in deals nationwide was $3.43 percent.

Data compiled by PitchBook, a national firm that tracks public and private equity markets, including venture capital, private equity and mergers and acquisitions, finds that nationally, there has been a steady rise in the amount of seed-stage activity since 2008, with $3.7 billion in funding in 2017. Colorado’s percentage of that funding was 2.98 percent. Back in 2008, Colorado’s percentage of $266 million in deals nationwide was $3.43 percent.

Colorado technology incubator Innosphere, which collaborated with PitchBook on the data, said that the number of seed stage deals rose sharply between 2011 and 2014 but has declined ever since. The amount of money given out continues to rise, however.

“That implies that there are fewer seed stage deals being funded across the U.S., but they are larger in size, which, in Innosphere’s estimation, further widens the seed stage funding gap.”

The report added that “even with significant growth in the Colorado ecosystem from 2008 until today, we have not grown the number of seed stage funding deals in the state.”

Seth Levine, a founding partner of Foundry Group, a Boulder-based venture capital firm with nearly $2 billion in assets under management, said that “for much of the last decade, Colorado has been considered a strong but second tier venture and startup market. We consistently rank toward the top of the tier that falls below the traditional venture and startup hot spots of Silicon Valley, Boston and New York.”

Venture investing in Colorado falls between $600 million and $800 million per year, Levine said. In 2017, there was an uptick in funding across stages but particularly in the venture category, which is funding beyond the seed and angel investing stages but before growth investing, he said. That amounted to $1.2 billion last year, up from $420 million in 2016, Levine said. Angel stage investing rose from $12.6 million in 2016 to $67 million in 2017.

“This doesn’t necessarily mean that demand is being satisfied,” he said. “Colorado is part of a larger movement in venture investing away from the coasts (sometimes referred to as “Rise of the Rest” after the Steve Case-backed fund that invests outside of the coasts). It’s a real trend and one that we’re well poised to take advantage of.”

Levine added that the state continues to be a net importer of talent and that the geography of startups in Colorado is shifting.

“What used to be very Boulder-centric is moving not just down Highway 36 to Denver, but also up and down the Valley Highway to markets like Fort Collins and Colorado Springs,” he said.

He agreed that Colorado is known for investing in technology, food and natural products, biosciences and cannabis-related products.

“It’s almost always the case that there are more companies looking for capital than there is capital available and there will always be entrepreneurs who feel that their businesses aren’t getting the attention and funding they deserve,” Levine said.

Boomtown Accelerators provides seed funding, mentoring and business help for early-stage startups across 16 industries. Its 12-week programs, which are offered twice per year in Boulder and Atlanta, help entrepreneurs not only flesh out their ideas but provide them with ongoing support in getting their businesses off the ground.

Boomtown’s Krout said that one thing that is rarely spoken about in early stage funding is that the amount of money a startup raises in its early round of financing has an inverse correlation to its success. That has played out time and again over the past 20 years in Boomtown’s own portfolio of startups.

“Venture capital has such a huge megaphone,” Krout said. “In a lot of ways we have convinced a generation of early stage entrepreneurs that the most important thing is to get a check from an angel or get validation from a venture capitalist when the reality is, they probably would be much better off just focusing on or obsessing about a customer and a problem space and focusing on getting a check from a customer and a repeat check from a customer.”

Mike Freeman, CEO of Innosphere, said that even though Colorado’s economy has been doing great and has low unemployment, “when you look at the underlying data what it suggests is that we are growing a lot of jobs but not in the tech sector.”

He added that there have been a number of new seed stage funders coming online in Colorado over the past couple of years, including the Innosphere Fund, a seed-stage venture capital fund that had raised $6.4 million as of August 2018. But the state is still not keeping up with demand.

Many long-time venture capitalists in the stage are at the tail end of their funds, Freeman said, and it isn’t clear whether they will seek to raise new funds or close out their operations. Most of the funds in Colorado are predominantly software oriented, he said.

Of course Colorado has burgeoning medical, energy and advanced materials industries, but those industries are not as “sexy as the software and artificial intelligence that tend to capture the interest of more established venture capitalists out here,” said Freeman.

Brad Bernthal, associate professor of law at Colorado Law School and director of the Entrepreneurship Initiative at Silicon Flatirons Center, said that sector does matter when it comes to financing. Entrepreneurs in the information technology arena have a much easier time finding funding than those in clean technology or biotech.

Over the past decade, accelerators have become an important source of pre-seed stage funding along the Front Range. Crowd funding sources like Indiegogo and Kickstarter have also become popular ways for entrepreneurs to fund projects. Various competitions across the state are another way entrepreneurs can get a small financial lift during their early stage of development.

“None of those are serious venture capital rounds but all are a way to get yourself off the ground if you are a startup,” Bernthal said.

If a company does fall into the information technology space — including software, cybersecurity, AI, virtual reality and augmented reality — Colorado does have a robust angel investing scene here, he said.

Biotechnology has been a challenging space to get funding, he said, in large part because it is a more capital intensive endeavor and the time it takes to get to an exit is often longer and will take a little more money relative to information technology. Because of that, investors would rather take a swing on information technology in the area, Bernthal said.

Family offices are becoming more active in funding startups, especially as angel investors, Bernthal said. That’s because to invest in a company at the value-creation stage “almost by necessity you need to dip into the private company investment space,” he said. There are fewer public companies today than there were in 1998 and the companies out there are more mature so there’s less emerging growth out there in the public markets, he said. “So, if you want to get into companies that have a value creation opportunity, you have to dip into a private office to get into high growth possibilities.”

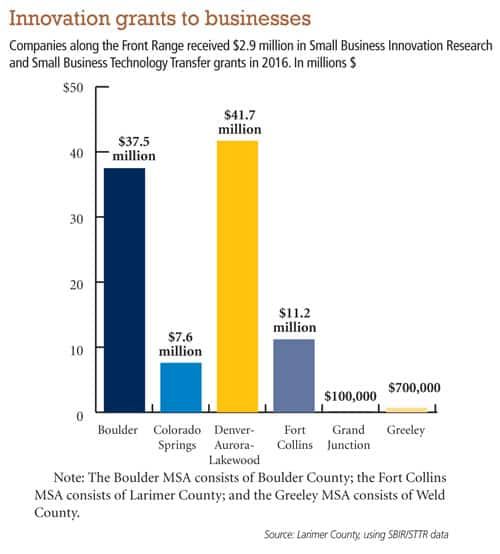

Bernthal said he would like to see some new funds formed in the future that have a Colorado focus. He said that entrepreneurs in places like Grand Junction, Durango or Pueblo have a much harder time finding the resources they need to start a business because there isn’t a lot of startup infrastructure in those locations. To be successful, companies need funding sources, mentors, access to accountants, attorneys and marketing people who have experience with the innovation economy and the ability to attract the right talent.

“If you are in a place where people understand how startups work, you get all sorts of help that gives you a chance to succeed,” Bernthal said. “If you are in a place where those things are lacking, it is a real challenge.”

Boomtown Accelerators works closely with founders to help them see that the most important thing isn’t to get funding.

Krout said that many times, when startups are pitching to investors or area accelerators, they are forced to hide their vulnerabilities and weaknesses.

“Early stage investors and accelerators already know that startups have weaknesses and vulnerabilities. The more honest they are, the more likely they will be successful,” Krout said. “When we accept a company into our accelerator we have to teach them to validate their assumptions to battle their own confirmation bias.”

Boomtown’s goal is to make sure entrepreneurs are the most prepared they can be before they turn to investors for money. If anything, the accelerator wants to make sure founders get to keep a larger share of their company as part of any deal they strike with investors.

He said that many founders are trying to get funding before they even have a business but if they spend time focusing on their business and their end goal it is possible they will be able to move forward without having to tap outside investors immediately.

Even if a startup is successful in courting investors, it can’t just sit on its laurels. If they have a good idea, competitors will soon spring up and if the initial entrepreneur doesn’t have a solid business model, “another startup will come in and eat your lunch,” Krout said.

Finding financing for entrepreneurial projects has never been easy. There have always been more entrepreneurs looking for financing than there is financing in the state, mainly because Colorado is such an attractive place to be it attracts people with an entrepreneurial spirit.

Finding financing for entrepreneurial projects has never been easy. There have always been more entrepreneurs looking for financing than there is financing in the state, mainly because Colorado is such an attractive place to be it attracts people with an entrepreneurial spirit.

Toby Krout, executive director and co-founder of Boomtown Accelerators in Boulder, has been in the industry in Denver since 1994. He said that even back then, people complained about the lack of venture capital funding across the Front Range. He said that Colorado has “some amazing and…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!