Fintech investor Ron Suber embraces “Enough” with Colorado relocation

BOULDER — Fintech investor Ron Suber’s tattoo explains his pivot and move from the San Francisco Bay area to Colorado.

Suber, managing partner of ReWired Inc., had “Enough” inked on his ankle early last year at Bondi Beach in Australia.

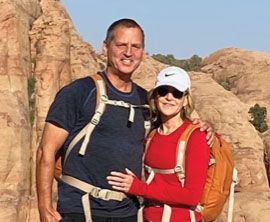

“It’s to remind myself that now I’m in my 50s that I had enough,” said Suber, 55. “I want to try to pivot my own life and do more charities and travel with my wife, Caryn.”

SPONSORED CONTENT

Exploring & expressing grief

Support groups and events, as well as creative therapies and professional counseling, are all ways in which Pathways supports individuals dealing with grief and loss.

Suber sold his San Francisco home and began a road trip Sept. 28 in the West as he and Caryn, who have been married for 29 years, find their next landing place over the next five to six months. They have a rental in Boulder and want to be closer to their 26-year-old daughter, one of their two children, who lives in Denver. They officially became residents of the state Oct. 1.

“We are loving Boulder, the people, hikes, town, culture and more but have not decided 100% to buy a home in Boulder. We are renting in Boulder long-term as we explore much of Colorado,” Suber said. “We will 100% end up buying a home in Colorado and are Colorado residents.”

The Subers actively traveled the country for three years and realized that Colorado is their “happy place,” stopping in the state on many of their trips, Suber said. Though they love the Bay area, their home and the great views, they’d prefer to visit there instead of visiting Colorado, essentially flipping the coin, he said.

Suber, originally of Michigan, considers his move to be phase 2 of his ReWirement. He founded ReWire in August 2017 as a solopreneur of an investment company that now is registered in Colorado. He works from home but travels the world (primarily pre-COVID-19 pandemic) spending time in the offices of his advisory clients.

“ReWirement is the period of life between working fulltime and retiring and playing golf or tennis,” Suber said, explaining that it’s about no longer working the hectic, 50-hour work week. “It’s more advising, consulting and investing and less operating day to day. It’s adjusting the jets on my own rocket ship to a different orbit, so it’s flying at a different speed and at a different altitude and not landing, not retiring.”

Suber is not alone in adjusting and realigning professionally, personally and geographically, as well as to the new normal brought on by the pandemic. He blogs about change and his own story, including in three blog posts in Rewirement.co and 11 recent ones on LinkedIn and Twitter.

“I’m trying to inspire people in my writing,” Suber said. “We need to communicate, be resilient, be resistant and make changes.”

Suber graduated from University of California, Berkeley, in 1986 with a degree in economics. He started out as an operator running companies and made a career out of investing, working 20 years on Wall Street “during very strong years,” he said. He made investments “that worked out very, very well,” he said, mentioning DocuSign, which he saw scale from $2 billion to $40 billion. He also invested in payments and ecommerce companies, as well as fintech companies, or financial and technology companies that run the gamut from wealth management to lending companies, he said.

“I just got lucky and have good instincts,” Suber said. “I have some investments in some companies that should do very well.”

Suber runs a venture debt fund, has raised debt and equity for more than 25 fintech companies, and is an advisor and board member to dozens of others. He bought and built out Prosper Marketplace Inc., a San Francisco-based online lending service, and was a senior partner and board member of Merlin Securities from 2008 to 2012, when it was sold to Wells Fargo. He’s on the boards of companies like Qwil and Yieldstreet and an advisory board member to Juvo, Unison, Money360, HouseCanary, MoneyLion, EarnUp, Sundae, Even Financial and eOriginal. He also invested in and served as chairman of the board for Credible, which went public last year and was sold to Fox Corp..

“What I do is I invest in companies. I help operate and advise them, and I help them exit,” Suber said. “I help them scale, I help them pivot, and I help them grow.”

Suber is able to recognize rapidly emerging patterns and trends and capitalize on them from DocuSign to Merlin, said Bart Foster, a strategist and advisor at Sanitas Advisors LLC, in Boulder.

“He puts his money where his mouth is while providing shared experiences and lessons learned rather than advice,” Foster said. “He helps on the work and personal side, too, as entrepreneurs pivot and handle the many growth challenges and opportunities. … Ron is a good listener, introspective, collaborative and empathetic.”

Suber sees his role as “a little bit of a psychologist,” helping entrepreneurs with their business and personal issues, encouraging them to not forget their mental and physical health and their relationships and families. He finds that if those things fall apart, so will the business. He invests in entrepreneurs who identify a large problem or challenge and see an opportunity, working with them to raise the needed capital and execute their vision and dreams, he said. He also helps them with their marketing, product development, strategy, sales process, hiring, focus and execution of key metrics, he said.

“I’m helping entrepreneurs get through the hard spots and execute the good spots,” said Suber, adding that he’s worked with 30 entrepreneurs so far and is invested in 20 companies.

Suber’s main investment advice is to acknowledge that every company will have to pivot or change in order to survive economic and other changes, such as those brought on by the pandemic, he said.

“Helping entrepreneurs see the pivot, make the pivot, the turn, without crashing, is something I enjoy,” Suber said.

Suber looks forward to working with investors in Colorado and says his plans for investing are open and flexible.

“I think Denver has some awesome entrepreneurs with some great ideas that are even bigger and more popular than you can imagine today,” Suber said. “I’m looking forward to working with existing entrepreneurs and the existing venture investment community to make the whole Colorado pie even bigger.”

Suber also plans to get involved in charity work, including through his Suber Charitable Foundation that helps with equality, hunger and education issues worldwide. He is interested in giving back to his local community and becoming involved with charity work, he said.

“We’re looking to find the right charity we can be part of and be part of the team,” Suber said.

Suber also takes time for some of his loves and hobbies outside of work, including hiking, biking, swimming, snow shoeing, traveling, reading and connecting with family and friends.

“One of the things that has been amazing here, the Boulder and Denver community has reached out to offer a helping hand,” Suber said about the advice he’s gotten about where to go to get various services and the multiple invites for hikes and dinners. “We’ve been overwhelmed by the openness and kindness of the Colorado community.”

BOULDER — Fintech investor Ron Suber’s tattoo explains his pivot and move from the San Francisco Bay area to Colorado.

Suber, managing partner of ReWired Inc., had “Enough” inked on his ankle early last year at Bondi Beach in Australia.

“It’s to remind myself that now I’m in my 50s that I had enough,” said Suber, 55. “I want to try to pivot my own life and do more charities and travel with my wife, Caryn.”

Suber sold his San Francisco home and began a road trip Sept. 28 in the West as he and…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!