Housing market likely will remain robust

As we usher in 2019, let’s identify some of the key factors likely to influence our real estate market in the coming months.

As we usher in 2019, let’s identify some of the key factors likely to influence our real estate market in the coming months.

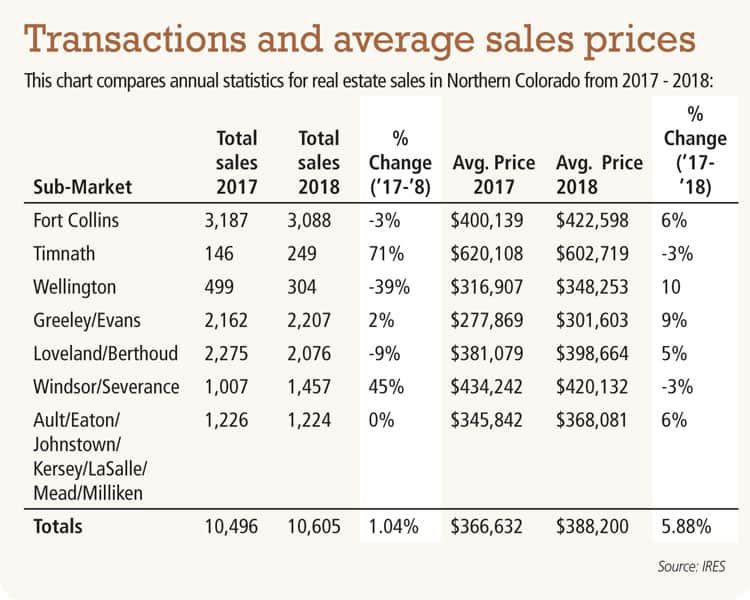

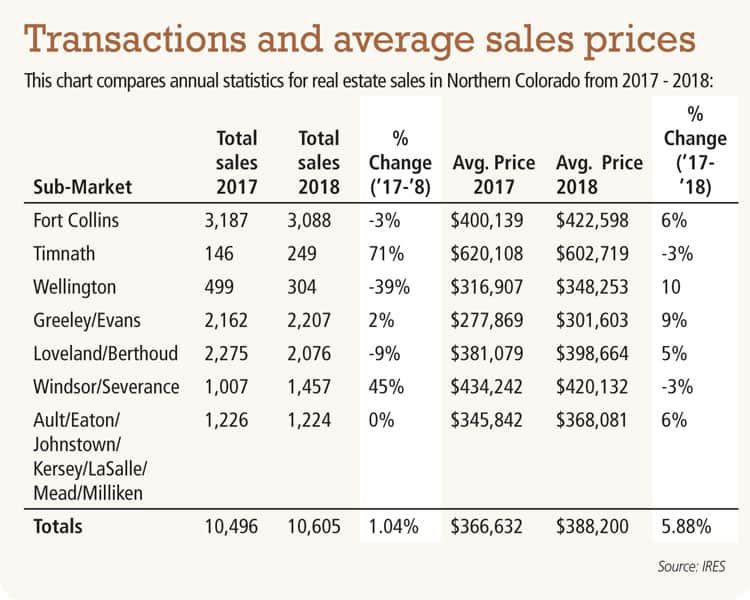

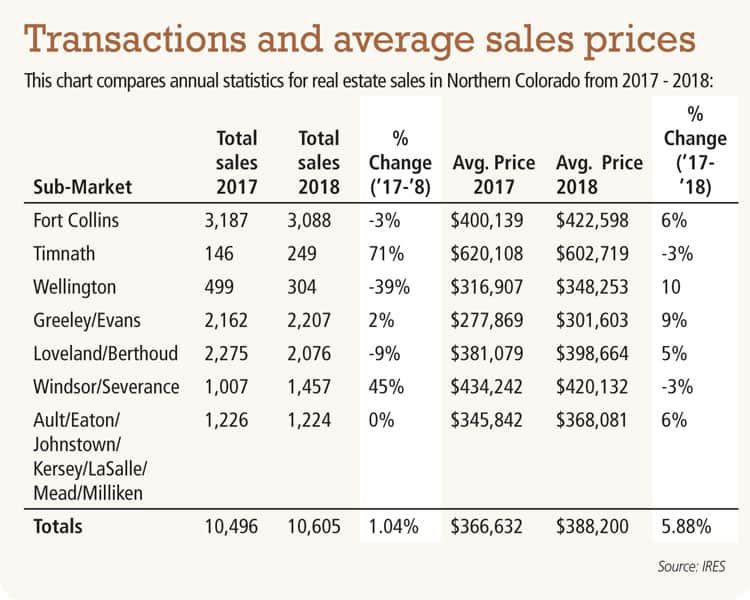

First, we know that jobs drive housing demand. And here in Northern Colorado we have cause to be enthused by continuing local job growth, along with related upswings in new business formation and population growth. Additionally, unemployment remains low, locally, statewide, and nationally.

We also started to see an impact last year caused by 2017 federal tax reform, which limited the deductions that people could take from local and state tax bills. Consequently, residents in high-tax states — largely on the East and West coasts — are starting to look at low-tax areas like Colorado as a more affordable option. That’s a trend that we see continuing.

SPONSORED CONTENT

Colorado’s housing market also stands to gain from changes in the state’s construction defects laws, which previously made condominium developers and builders easy targets for lawsuits, a fact that deterred contractors from beginning new condo projects. As condo development picks up momentum, it will mean more options for entry-level homeowners.

We also need to call out some potential hurdles for housing, starting with the high tariffs on imported Canadian lumber — an important source of supplies for U.S. homebuilders. These tariffs add costs to builders, which in turn affects housing prices.

Speaking of prices, Northern Colorado has been dealing with a low supply of homes for sale for a several years running. And the resulting lack of inventory has been a key reason for a sellers’ market here. There are signs the tide could be turning (including the construction defect law mentioned earlier), but it’s going to take time before we get back to a market that’s balanced between buyers and sellers.

Collectively, these are reasons to be concerned that housing affordability will remain a challenge in 2019, especially for first-time homebuyers.

There were also some end-of-year dynamics that set off some alarms in the broader economy, which caused some to speculate that housing was in trouble. Notably, as the Federal Reserve ratcheted up its target federal funds rate and the stock market experienced dramatic swings, we heard more speculation about a pending recession or a burst in a so-called housing bubble.

But if we step back from the noise, we see ample reasons to stay confident. Gross domestic product, for example, was on pace for 3.4 percent growth last year at the end of the third quarter — even stronger than the 2.5 percent rate for 2017. And the topsy-turvy stock market could, in fact, keep mortgage rates from moving too fast. We saw that last fall when 30-year mortgage rates climbed above 5 percent, then dropped back below 4.5 percent after investors moved their money to bonds to find a safe haven from financial markets volatility.

We’re already seeing the upside of that mortgage rate reversal here in Northern Colorado. In January, The Group family of companies saw a significant increase in loan applications, mortgage originations, home showings and contracts compared to January 2018.

As we look ahead, we recall that in each of the past three years, there were reasons for people to doubt the housing market. We proved the skeptics wrong before.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado

As we usher in 2019, let’s identify some of the key factors likely to influence our real estate market in the coming months.

As we usher in 2019, let’s identify some of the key factors likely to influence our real estate market in the coming months.

First, we know that jobs drive housing demand. And here in Northern Colorado we have cause to be enthused by continuing local job growth, along with related upswings in new business formation and population growth. Additionally, unemployment remains low, locally, statewide, and nationally.

We also started to see an impact last year caused by 2017 federal tax reform, which limited the deductions that…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!