One piece of the inventory puzzle may be taking shape

Last month in this space we identified three potential answers to the burning question of how much-needed housing inventory will be generated for Northern Colorado in the year ahead. Those possibilities included (1) the growth of new construction in the region’s smaller communities, (2) existing owners who might opt to sell in order to move up — or downsize, and (3) residential property investors looking to take advantage of the high demand and reallocate part of their portfolios.

Last month in this space we identified three potential answers to the burning question of how much-needed housing inventory will be generated for Northern Colorado in the year ahead. Those possibilities included (1) the growth of new construction in the region’s smaller communities, (2) existing owners who might opt to sell in order to move up — or downsize, and (3) residential property investors looking to take advantage of the high demand and reallocate part of their portfolios.

We’re beginning to see signs of at least one of those factors taking shape early in the year.

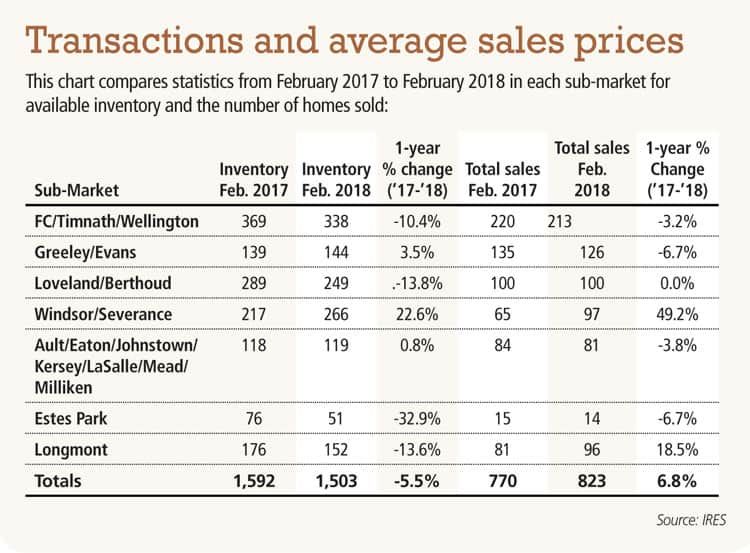

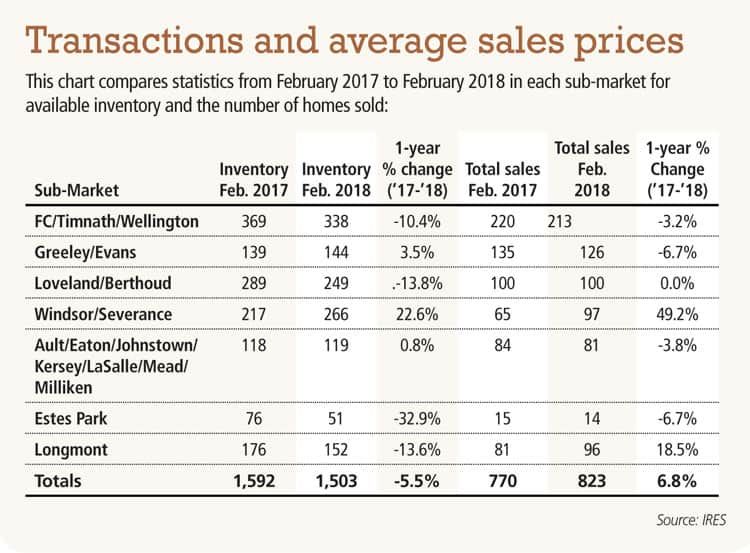

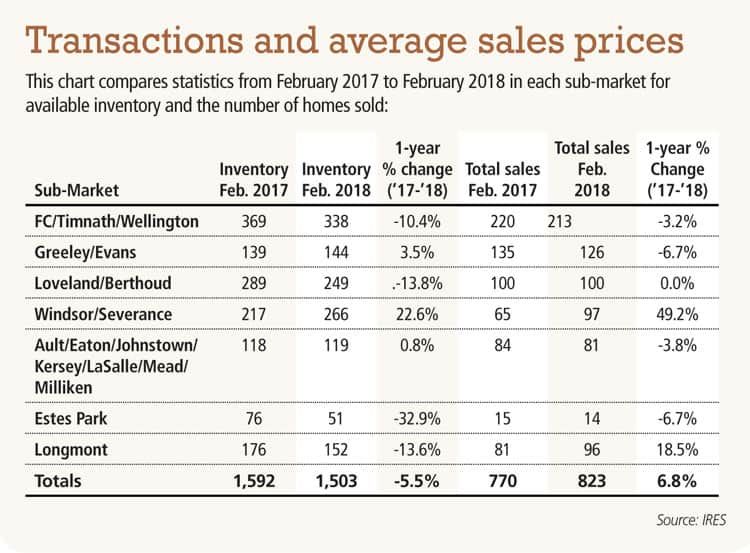

In two communities where new construction has been especially active, we’re witnessing a bump in available homes for sale. In Timnath, for example, Multiple Listing Service inventory increased from 45 homes in February of 2017 to 73 this year, a year-over-year gain of 62 percent. For the Windsor-Severance area, inventory increased from 217 to 266, up 22 percent. It’s noteworthy to point out much new home construction inventory in not reported in MLS data, so the actual amount of inventory is significantly higher.

SPONSORED CONTENT

The many benefits of simple, coordinated healthcare

Kaiser Permanente combines health care and coverage in one connected system to maximize employee health and minimize employer costs.

We’ll be watching to see if these patterns continue. But for now, it’s fair to say that Timnath and Windsor-Severance are bucking the broader trend across the region when it comes to inventory. Combining all Northern Colorado markets, inventory in February slipped by 5.5 percent, showing that supply continues to be constrained.

Looking at individual sub-markets:

The Fort Collins area — which includes Timnath and Wellington — experienced a 10.4 percent decline in inventory from February 2017 to February 2018. For Fort Collins alone, the decrease was 15 percent.

Similarly, supply was down 13 percent for both Loveland-Berthoud and Longmont, and 11 percent for Boulder.

Estes Park reported the sharpest annual drop for February, with inventory down 32 percent from last year.

Greeley-Evans showed a slight uptick of 3.5 percent, from 139 to 144, and the combined group of smaller Weld County communities — Ault-Eaton-Johnstown-Kersey-LaSalle-Mead-Milliken — stayed essentially flat, increasing from 118 to 119.

While an overall lack of inventory is limiting options for homebuyers, it’s not limiting demand — total sales across the region were up 6.9 percent in February. Factors such as job growth and tax reform, and the motivation to act before interest rates rise, are all driving activity thus far in 2018. Consequently, we are seeing more frequent multiple offer scenarios and steep competition for well-priced and well-presented homes. And not surprisingly, average prices continue to escalate at nearly double-digit rates in most communities.

Here are some other observations of the February figures:

It’s worth noting that in one of the communities where inventory increased the most, sales were strongest. Transactions in Windsor-Severance, with its 22 percent growth in housing supply in February, were up 49 percent for the month.

Windsor-Severance also experienced a rare dip in average prices, slipping 3.7 percent to $379,948, due largely to the availability of more entry-level and mid-priced homes.

Average sales prices in the Fort Collins area topped $400,000, increasing 9.5 percent to $410,747.

Loveland-Berthoud prices are nearing $400,000, averaging $398,886 for the month, up 7.8 percent. At the same time, Greeley-Evans prices are closing in on $300,000, with an average February price of $296,707 — up 14.5 percent.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado

Last month in this space we identified three potential answers to the burning question of how much-needed housing inventory will be generated for Northern Colorado in the year ahead. Those possibilities included (1) the growth of new construction in the region’s smaller communities, (2) existing owners who might opt to sell in order to move up — or downsize, and (3) residential property investors looking to take advantage of the high demand and reallocate part of their portfolios.

Last month in this space we identified three potential answers to the burning question of how much-needed housing inventory will be generated for Northern Colorado in the year ahead. Those possibilities included (1) the growth of new construction in the region’s smaller communities, (2) existing owners who might opt to sell in order to move up — or downsize, and (3) residential property investors looking to take advantage of the high demand and reallocate part of their portfolios.

We’re beginning to see signs of at least one…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!