Debt puts higher ed in the red

Students bear brunt of costs in lieu of dwindling state funds

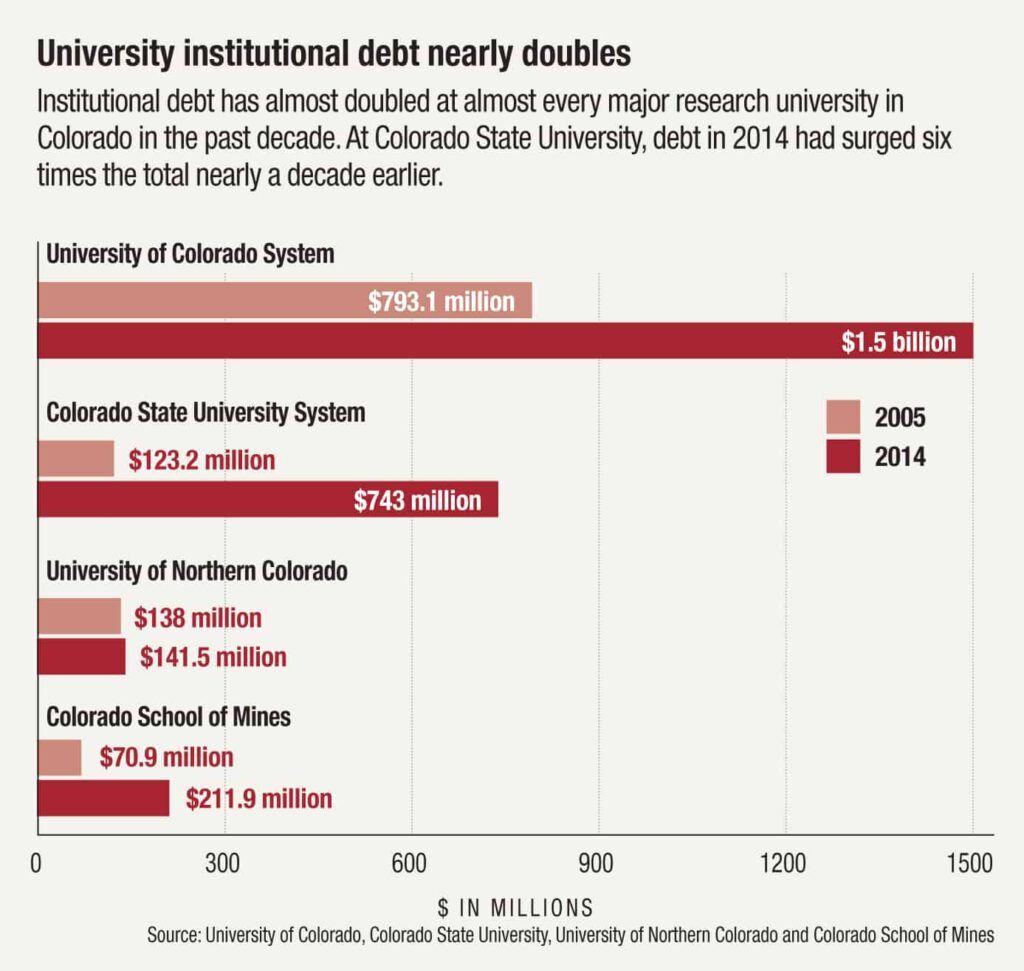

FORT COLLINS — Debt loads at Colorado’s major research universities have more than doubled in the past 10 years, as the schools embarked on a building boom to upgrade dorms, athletic facilities and classrooms.

The borrowing costs at the University of Colorado Boulder, Colorado State University and Colorado School of Mines are being paid largely by student tuition and fees, which also have more than doubled. Private gifts have also helped cover some of the costs.

At the same time, state support for the schools has dropped by roughly two-thirds.

SPONSORED CONTENT

People Powered: Preparing Longmont Businesses for Economic Success

Longmont Chamber and FNBO present People Powered on April 24, 2024, aiming to inform business owners about workforce development, housing, and transportation issues.

The University of Northern Colorado in Greeley is the only school whose debt load hasn’t grown.

Debt at universities nationwide has soared in recent years, prompting the rating agency Standard & Poor’s, in the fourth quarter of last year, to issue more negative debt ratings on universities than any other institutions in the public-finance sector.

University officials in Colorado defend the debt loads, saying the state’s unwillingness to provide tax dollars to revamp aging structures and build modern amenities left them no option but to borrow. They also point out that the borrowing has occurred while interest rates are low, making the projects less costly and allowing them to save money by refinancing at lower rates.

“We’re getting $20 million a year from the state on inventory that’s worth $3.3 billion,” said Richard Schweigert, CSU’s chief financial officer. “You have to do something.”

Critics, however, question the burden this institutional debt is placing on students and their families. Some also question whether the new construction even is necessary, given that growth in student enrollment is projected to slow significantly in the coming years.

“Most of the cost of this ultimately falls on the people who make the largest payments to the university – the students,” said Richard Vedder, an Ohio University economics professor and director of the Center for College Affordability and Productivity in Washington, D.C. “The state of Colorado isn’t going to pay it.”

CSU debt skyrockets

Of the three schools, CSU’s debt load has grown the fastest. At the end of 2014, it had $743 million in debt, more than six times the amount it owed 10 years ago. It now has $982 million in debt after a bond sale this spring to fund construction of a new $220 million on-campus football stadium. The university also plans to take on an additional $160 million in debt to build a new medical center, bringing its total debt load to more than $1.1 billion.

Much of the borrowing is tied to construction projects, including new academic buildings and dormitories, according to CSU and other universities. Universities maintain that their approach is sound and has been affirmed by their strong credit ratings and largely stable financial outlook.

Still, critics say that the universities are borrowing at the expense of students, who fund debt payments through increased tuition and fees. This has occurred at a time when state support for students has dwindled. In 2000, the state funded 68 percent of a student’s cost of college, while students paid 32 percent, according to a report by the Colorado Department of Higher Education. By 2010, the state funded just 32 percent, increasing students’ share to 68 percent.

Although low interest rates have made borrowing money for construction easier, the increase in online education and slowing student population growth may mean all the new space will be underutilized, Vedder said. Universities also tend to have lower building utilization rates compared with buildings in the private sector, especially during summer when fewer students take classes.

“It’s not clear we need to build all this space,” Vedder said. “The notion that we’re going to have continuing, robust enrollments is somewhat suspect.”

The investment community also is growing concerned. In the fourth quarter, Standard & Poor’s issued the most negative ratings for universities of any institutions in the public-finance sector. There were eight credit-rating downgrades nationwide. No Colorado institutions saw their ratings downgraded, but CSU’s outlook was downgraded because of its high debt load.

“Our outlook on the industry overall is negative right now,” Standard & Poor’s credit analyst Jessica Wood said.

The outlook stems from concerns over the stiff competition for new students, declining high school student populations, increased costs to attend college and cuts in state funding.

In March. Standard & Poor’s revised CSU’s credit outlook, warning that borrowing could “exert greater pressure on financial resources that we already view as very weak.” Moody’s Investor Service maintained a stable outlook on CSU’s credit.

Standard & Poor’s outlook reflected the credit agency’s concerns about CSU’s significant increase in borrowing over the past few years, Wood said.

“We do believe their leverage is getting high,” she said. “Based on our criteria, for their current rating, they are getting close to reaching their debt capacity.

“Given the increase in debt over time, the balance sheet hasn’t really kept up with its peers,” she added.

Wood noted, however, that CSU’s rising enrollment as well as its abilities to fundraise and draw nonresident students has helped maintain the school’s credit rating.

“They have some of that national reach that we like to see,” she said. “Those factors are positive.”

Despite the concerns, Standard & Poor’s and Moody’s Investors Service maintained CSU’s underlying bond ratings ahead of the stadium bond sale.

As state support has declined, Schweigert said, the university has gone into greater debt to fund construction of new facilities to replace or renovate older buildings. Two-thirds of CSU’s buildings are at least 25 years old, and nearly one-third are at least 50 years old.

To deal with its aging facilities, CSU increasingly has turned to students, who have agreed to raise fees to fund construction. In the meantime, interest rates have remained at historic lows, making now a good time to build and helping CSU save “tens of millions of dollars,” Schweigert said.

He expects the university’s debt to grow at a “pretty aggressive” pace over the next few years, and then drop off after that.

“While nobody wants to do that, the reality of getting tax dollars, or not getting tax dollars, is out of our control,” he said, “even though we make as hard a case as we can as to why they (state lawmakers) should fund higher ed.”

CU debt hits $1.5 billion

The University of Colorado system, meanwhile, has accumulated $1.5 billion in debt in 2014, nearly double its $793.1 million in debt in 2005.

The debt partly has funded projects such as the Jennie Smoly Caruthers Biotechnology Building on CU’s East Campus, athletics facilities at CU Boulder; and student commons at CU Denver.

The university’s debt-service payments are 5.6 percent of the university’s total budget this fiscal year, below the 7 percent cap mandated by the CU Board of Regents, CU officials said. The university forecasts that that figure will remain between 5 percent and 5.5 percent over the next several years, said Todd Saliman, vice president for budget and finance.

In 2005, debt-service payments were 4.5 percent of the budget. CU says student tuition and fees will fund 22 percent of the debt repayment, while research funding and gifts will fund the remaining 78 percent.

The university also has refinanced its bonds over the years as interest rates have fallen, resulting in savings of about $15 million this fiscal year alone, CU Treasurer Don Eldhart said.

The University of Northern Colorado in Greeley and Colorado School of Mines in Golden, during the same period, have accumulated smaller amounts of debt.

At $141.5 million in 2014, only UNC’s debt has remained flat compared with $138 million in debt in 2005. Most of the debt owed by UNC stems from major renovations of buildings and parking lots in 2005, said Nick Taylor, director of North Slope Capital Advisors in Denver. The firm advises a number of universities on their finances, including UNC. The school’s debt-service payments represent 4.9 percent of the budget.

School of Mines’ debt has tripled to $211.9 million from $70.9 million in the past decade, said Peter Han, Mines’ chief of staff. The university contends that despite its higher borrowing, its debt-to-asset ratio has declined in the past 10 years.

Debt has funded dormitories, academic buildings and major facility renovations, including building structures that can accommodate expensive cutting-edge technology, he said. Tuition, fees, gifts and donations help fund the repayment of debt, depending on the facility.

Enrollment growth cited

Increased enrollments have driven the need for increased borrowing, Han said. Enrollment grew to 5,600 students last year from 3,600 10 years ago.

“When you grow enrollment by 60 percent, you increase faculty size, facility size and staffing,” he said. “Our facilities were not able to keep up with that.”

CSU in Fort Collins saw the highest enrollment growth, adding more than 6,300 students during the period. Enrollment grew to 31,700 from 25,400, a 25 percent increase.

Enrollment at the other universities has not significantly increased in the past decade.

At CU-Boulder, enrollment has risen by just 500 students, to 29,800 from 29,300, from 2004 to 2014.

Saliman said the university projects modest enrollment growth over the next few years.

“That’s why we don’t rely — more than we can safely afford — on students to pay for these facilities,” he said. “When we do rely on students, it’s for the academic facilities.”

As for online education, CU says it’s meant to supplement traditional coursework. At the same time, CU Boulder has planned a major building utilization study to better understand how it might use academic buildings more efficiently when fewer students are on campus during the summer and other times.

“We suspect that that in-depth analysis of Boulder is going to show that we can do a better job in that area,” Saliman said. “That will absolutely give us an opportunity to use our facilities more effectively instead of just building more.”

At UNC, enrollment actually declined slightly to 11,800 students from about 11,900 during the period.

College affordability advocate Vedder said universities’ institutional debt, along with the national debt and unfunded entitlements, are pressuring the nation’s financial stability.

“Our nation is in a bind as far as the debt obligations we’ve taken on,” he said. “For colleges to take on lots of new debt seems to me to be questionable.”

Steve Lynn can be reached at 970-232-3147, 303-630-1968 or slynn@bizwestmedia.com. Follow him on Twitter at @SteveLynnBW.

FORT COLLINS — Debt loads at Colorado’s major research universities have more than doubled in the past 10 years, as the schools embarked on a building boom to upgrade dorms, athletic facilities and classrooms.

The borrowing costs at the University of Colorado Boulder, Colorado State University and Colorado School of Mines are being paid largely by student tuition and fees, which also have more than doubled. Private gifts have also helped cover some of the costs.

At the same time, state support for the schools has dropped by roughly two-thirds.

The University of Northern Colorado in…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!