Sunnier skies forecast for Advanced Energy

‘Promising market’ awaits despite leadership shakeup

FORT COLLINS – Following a year of turbulence for Advanced Energy Industries Inc. (Nasdaq: AEIS), analysts see potential for more growth at the solar and precision-power products manufacturer.

The expectations for a healthy future for the Fort Collins-based company, known for its solar inverters, come despite the resignations of key executives and a struggling solar business.

Advanced Energy chief executive Garry Rogerson resigned June 2. Shares fell as much as 13 percent the next day. Advanced Energy solar-unit president Gordon Tredger also resigned his position May 5.

SPONSORED CONTENT

People Powered: Preparing Longmont Businesses for Economic Success

Longmont Chamber and FNBO present People Powered on April 24, 2024, aiming to inform business owners about workforce development, housing, and transportation issues.

Rogerson, who is staying with the company until a new CEO is hired, is receiving a payment of $600,000 plus a bonus that depends on how long he remains employed at Advanced Energy. Tredger was to receive a total of $241,000 in base salary and benefits following his resignation.

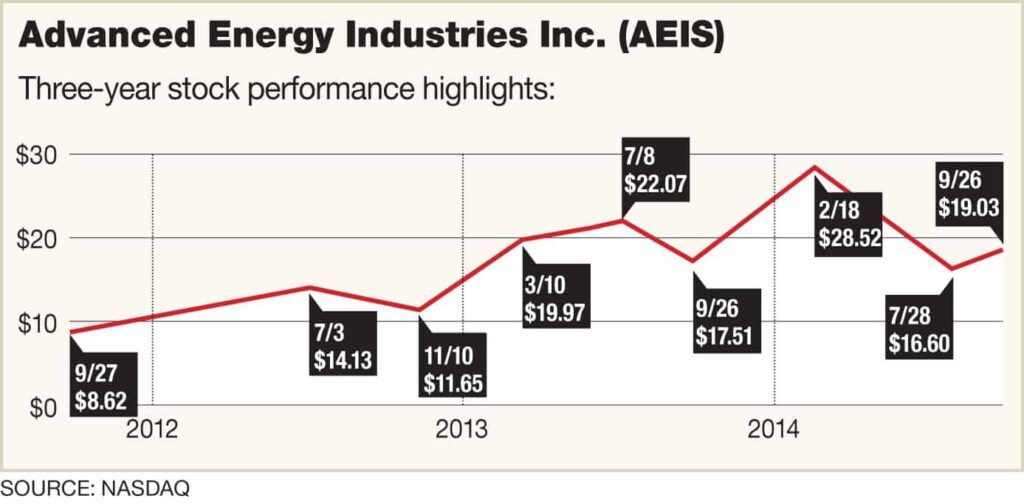

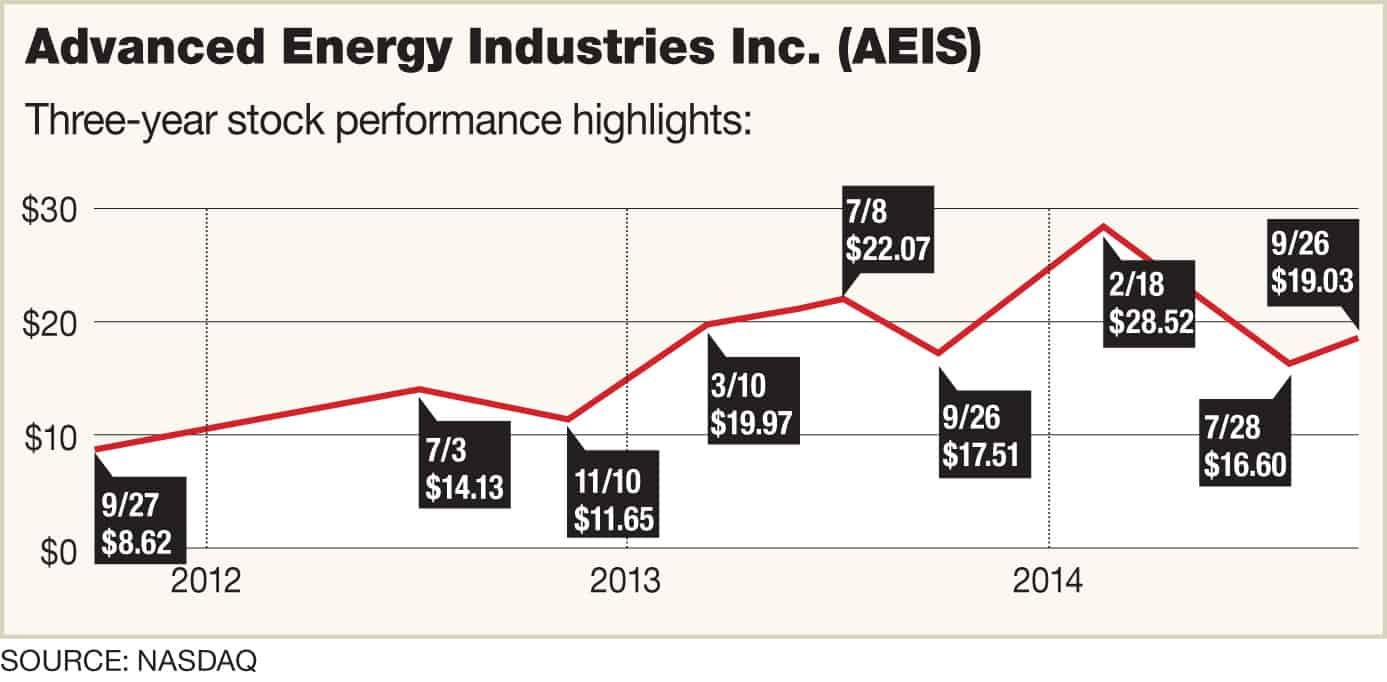

Company shares hit a 52-week-low of $16 per share Aug. 5 despite an announcement Aug. 4 that the company earned $10.6 million during the second quarter versus a $9.8 million loss the same quarter a year earlier. Second-quarter inverter sales declined to $64.5 million, a decrease of 5 percent from $68 million during the same quarter last year.

Rogerson blamed the loss in solar sales on lower expectations for utility-scale projects because of tariffs on Taiwanese panels, although he said the tariffs have not led to cancellations of solar farm projects.

“This is causing delays in large-scale projects where our center inverters were planned,” he told analysts during the second-quarter earnings conference call.

Following the earnings report, Danny Herron, chief financial officer for Advanced Energy, confirmed that layoffs had occurred in August at the company, although he did not respond to questions about how many people lost their jobs.

Company shares had risen to around $19 earlier this month, but have remained significantly below a 52-week-high of $29.15. Five analysts have rated the company a hold or a sell while four analysts have rated it a buy or strong buy, according to Yahoo Finance.

Advanced Energy employed 405 people in 2013, down from 509 the previous year, according to data compiled by BizWest. The company has said that it outsourced manufacturing on its solar subassemblies from Fort Collins to Shenzhen, China.

Despite the challenges endured by Advanced Energy, analysts predict growth in the company’s solar business as photovoltaic solar installations increase. The Solar Energy Industries Association projects that U.S. solar installations will grow to about 6,500 megawatts this year from 4,800 megawatts last year. The industry trade group estimates 8,700 megawatts of installations in 2015 and 12,400 megawatts in 2016.

“Broadly speaking, the solar market as a whole has been growing, especially in the U.S.,” said MJ Shiao, director of solar research for GTM Research in Boston. “It’s been a very promising market.”

Solar panel prices have dropped from about $2 per watt in 2010 to about 70 cents per watt because of a large supply of Asian panels. That has pressured inverter prices, which have dropped during the past two years.

However, the utility solar market for which Advanced Energy manufactures inverters represents the largest volume of solar installations, Shiao said, adding that the sector will continue to grow in the U.S. thanks in part to the solar-investment tax credit.

“In that space, Advanced Energy’s product lines are very much aligned,” he said.

The lower costs that have led to increased solar installations eventually will help solar compete with fossil fuels such as natural gas, which is expected to increase in price, said Bill Baker, founder of Baltimore-based GARP Research and Securities Co., who covers Advanced Energy.

Advanced Energy, meanwhile, will be making its inverters at a lower cost in Shenzhen, he said.

The company, however, will face challenges from Chinese competitors, leading to lower prices for its inverters, he said. Tariffs on imported solar panels also could delay profitability.

Despite those headwinds, the company still will see healthy margins, he said.

“Yes, it may be competitive, but the price of the inverter isn’t going to collapse,” Baker said. “You’re seeing their mainstay go through a transition and it’s obviously going to be restored.”

At the same time, Advanced Energy has made three acquisitions this year, moves Baker said will add future value to the company’s precision-power product line after Advanced Energy integrates those companies.

“The whole culture here is one where they transform a company,” he said. “Over time, this is a nice way for the company to diversify its core business.”

Steve Lynn can be reached at 970-232-3147, 303-630-1968 or slynn@bizwestmedia.com. Follow him on Twitter at @SteveLynnBW.

‘Promising market’ awaits despite leadership shakeup

FORT COLLINS – Following a year of turbulence for Advanced Energy Industries Inc. (Nasdaq: AEIS), analysts see potential for more growth at the solar and precision-power products manufacturer.

The expectations for a healthy future for the Fort Collins-based company, known for its solar inverters, come despite the resignations of key executives and a struggling solar business.

Advanced Energy chief executive Garry Rogerson resigned June 2. Shares fell as much as 13 percent the next day. Advanced Energy solar-unit president Gordon Tredger also resigned his position May 5.

Rogerson, who is…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!