Tweet or tweak, then send

Twitter map new lobbying tool for bankers

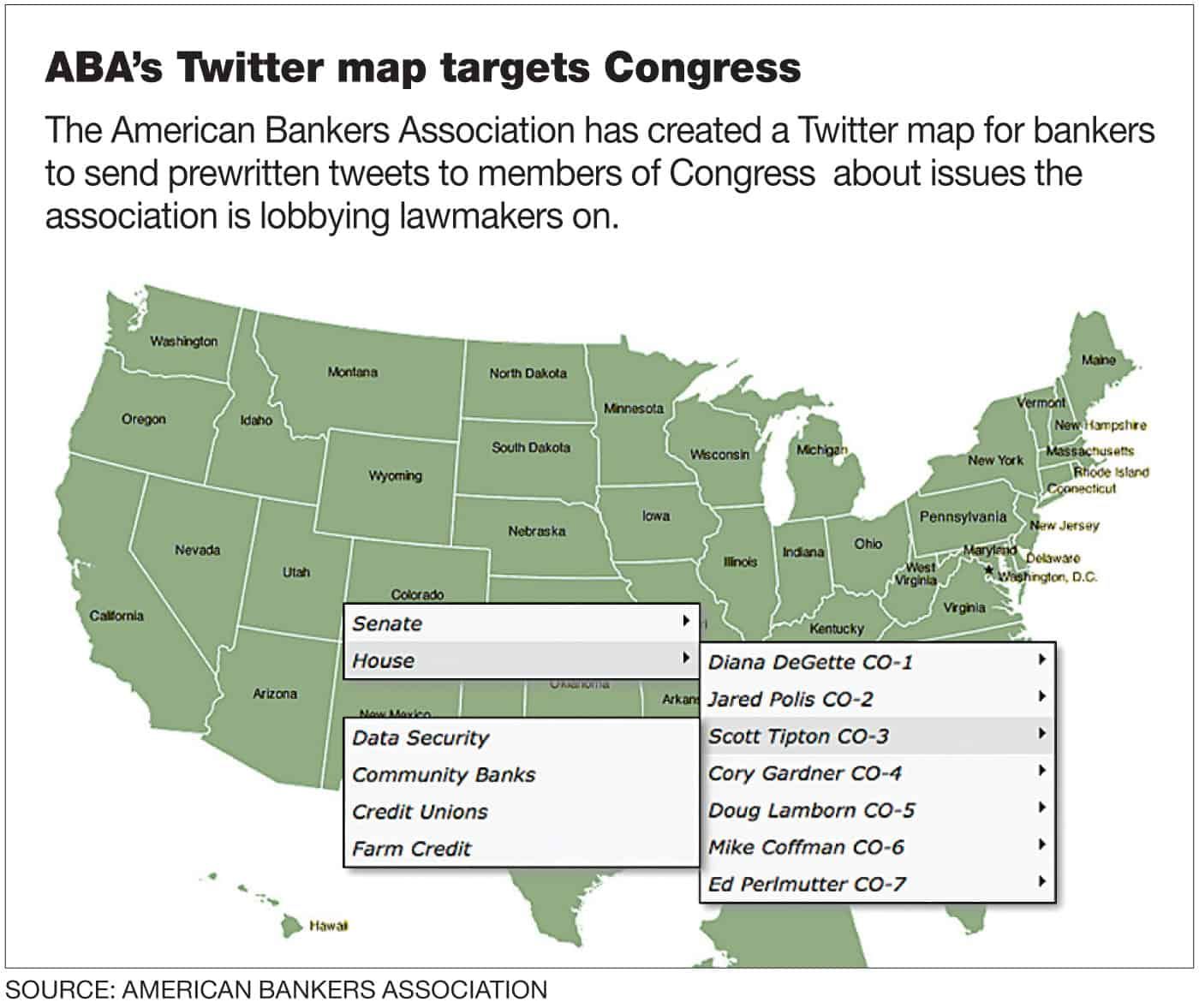

Most U.S. Senate and House members use Twitter as a way to engage with constituents. Not to be left out, the American Bankers Association has created an online map-based Twitter platform that allows bankers across the nation to shoot prewritten tweets about the industry’s burning issues to those politicos.

By hovering over a state on the map, bankers can choose a member of Congress and tweet a prewritten message, or tweak that tweet, staying within 140 characters.

The hope is to make it easy for Twitter-friendly bankers to flood lawmakers’ Twitter accounts urging action on key issues. All members of Colorado’s congressional delegation have Twitter handles.

SPONSORED CONTENT

Business Cares: April 2024

In Colorado, 1 in 3 women, 1 in 3 men and 1 in 2 transgender individuals will experience an attempted or completed sexual assault in their lifetime. During April, we recognize Sexual Assault Awareness Month with the hopes of increasing conversations about this very important issue.

The average age of Twitter users in the United States is 25.6, according to New York-based Statistica Inc. Chris McVay, vice president and Longmont market manager for High Plains Bank, is one of the younger banking executives in the region at 33.

McVay uses Facebook to promote some of the bank’s activities in the community such as fundraisers. “I don’t do much on Twitter,” he said.

He had not heard of the ABA’s service, but said it sounds like a “fast, efficient way to communicate.” He said High Plains would need to explore it further before having any of its bankers use it.

“We’d have to make sure we would be in compliance with social media guidance,” set last year by the Federal Financial Institutions Examination Council, he said. The council’s general guidelines include a section on the need to understand risks pertaining to reputation associated with the use of social media.

Online: www.aba.com/advocacy/grassroots/pages/Twitter-map.aspx?

James Ballentine, the ABA’S Washington-based executive vice president for congressional relations and political affairs, is hoping bankers of all ages will participate in the lobbying campaign.

“These issues have taken on critical importance to bankers and taxpayers across the country,” he said. “This map provides bankers with a quick and easy way to educate members of Congress on the issues their constituents are facing.”

For those who embrace the Twittersphere, the first four topics the association is targeting are about regulatory burden on community banks, data security, credit union tax exemptions and the farm credit system.

Regulatory burden

The association contends that community banks need regulatory relief bills passed, such as the Portfolio Lending and Mortgage Access Act. This bill would amend the Truth in Lending Act by allowing a creditor to presume that a residential mortgage loan has met the requirement that the borrower has a reasonable ability to repay it, if the loan is a qualified mortgage. The bill would broaden the definition of qualified mortgages to include mortgages held on a lender’s balance sheet. And it would limit the right of borrowers to file claims against holders of such loans.

• The tweet: So many new regs, it’s tough for banks to serve our customers. @repmikecoffman please support banks in your district. #regburden

Data security

The association wants Congress to hold retailers and others to nationwide standards for safeguarding customer information and breach notification – and that those responsible for data breaches also are responsible for their associated costs.

• The tweet: Banks protect data & notify customers of #breaches – @markudall this constituent asks 4 nat’l standard 4 merchants #datasecurity

Credit unions

The association believes it’s time to get rid of what it calls “the unnecessary and outdated tax exception that is no longer justified. Credit unions have moved away from their original mission, and have outgrown their special tax-exempt status. Taxpayers can no longer afford to continue subsidizing the credit union industry to the tune of $2 billion a year.”

• The tweet: As a constituent, I ask @reptipton to support ending the credit union tax exemption. #itstime2pay

Bill Hampel, interim president and chief executive of the Credit Union National Association, said the key distinction between banks and credit unions that warrants the tax exemption is that the beneficiaries of credit unions are the members that they serve, while the beneficiaries of banks are their shareholders. He said because of credit unions’ cooperative ownership structure, any excess profits they earn are redirected back to all members in the form of lower loan interest rates and higher savings yields.

Farm credit

The association wants Congress to reform the Farm Credit System, arguing that it is “imperative in creating a level playing field for agricultural community banks. The U.S. can no longer afford this $247 billion government sponsored enterprise.”

• The tweet: Golf courses aren’t farms. As a constituent, I ask @repcorygardner to support farm credit system reform. #farmcredit

Ken Auer, president and chief executive of the Farm Credit Council, wouldn’t comment on the ABA’s Twitter campaign. But he said Farm Credit uses social media to promote a “fact-based conversation about how it supports agriculture and rural America. … We use communications tools like Twitter to tell members of Congress the success stories of the Farm Credit customers they represent.”

The map is available through Amplify, the association’s free advocacy platform. Bankers don’t have to be association members to create an account.

Doug Storum can be reached at 303-630-1959, 970-416-7369 or dstorum

@bizwestmedia.com.

Twitter map new lobbying tool for bankers

Most U.S. Senate and House members use Twitter as a way to engage with constituents. Not to be left out, the American Bankers Association has created an online map-based Twitter platform that allows bankers across the nation to shoot prewritten tweets about the industry’s burning issues to those politicos.

By hovering over a state on the map, bankers can choose a member of Congress and tweet a prewritten message, or tweak that tweet, staying within 140 characters.

The hope is to make it easy for Twitter-friendly bankers to flood lawmakers’…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!