Bank profits improve, but benchmark elusive

Verus has region’s highest ROA

It was hard to tell what was causing Verus Bank of Commerce chief executive Gerard Nalezny to lose his breath: the stunning powder he was experiencing during a recent ski trip in the mountains — from which he took a break for a telephone interview — or his bank’s latest financial numbers.

Fort Collins-based Verus indeed posted some breathtaking numbers at year-end 2015: a record $5.75 million net profit, a 2.1 percent return on assets (ROA) and a 17.69 percent return on equity. The latter two, the bank notes in a statement, are “both in line with the top-performing banks in the country.”

Although he expresses pride in each of those numbers, Nalezny settles on the one statistic that he believes places the bank in a league with no other: its fourth annual dividend to shareholders, issued Jan. 13, amounting to 80 cents per share, or a 13 percent annualized return on shareholder equity.

SPONSORED CONTENT

The many benefits of simple, coordinated healthcare

Kaiser Permanente combines health care and coverage in one connected system to maximize employee health and minimize employer costs.

“It’s hard to track, but as best as I can tell, it’s the highest” nationwide, Nalezny said. “I don’t think you’d find too many banks that are even paying dividends, let alone any that are paying anywhere near ours.”

Dividends, after all, are driven by profits, but most banks operating in the Boulder Valley and Northern Colorado continue to struggle to achieve the industry benchmark of 1 percent ROA, calculated by dividing net income by average total assets.

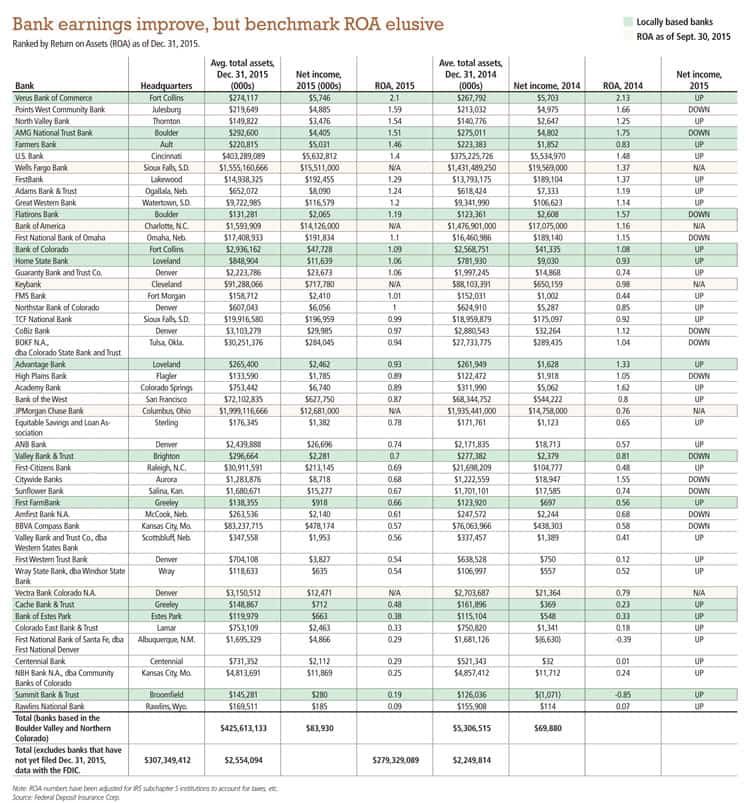

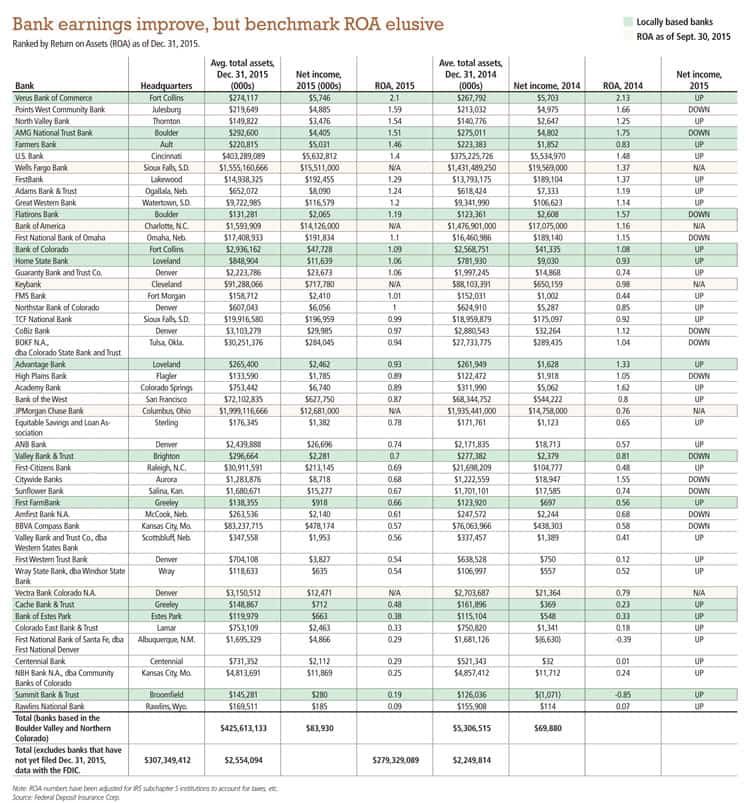

A BizWest analysis of banking-industry data from the Federal Deposit Insurance Corp. found that only 19 of the 48 national, regional and local banks operating in Boulder, Broomfield, Larimer and Weld counties had achieved the industry benchmark of 1 percent ROA, with four others hovering within a few percentage points.

ROA is computed by dividing net income by total average assets. In Verus’ case, its $5.75 million net profit, divided by its $274 million in assets, comes out to 2.1 percent ROA.

Of the dozen banks based in the four counties and Brighton, only five achieved ROA of at least 1 percent as of Dec. 31, with Verus at the top. Others included Boulder-based AMG National Trust Bank at 1.51, Ault-based Farmers Bank at 1.46, Boulder-based Flatirons Bank at 1.19, Fort Collins-based Bank of Colorado at 1.09, and Loveland-based Home State Bank at 1.06.

Dec. 31 data for several of the large, national banks active in the region is not yet available through the FDIC, but U.S. Bank recorded an ROA of 1.4.

Although few banks have hit the benchmark yet, improvements are widespread. Nine banks based in the region recorded higher net income than a year ago, with only three — AMG, Flatirons Bank and Brighton-based Valley Bank & Trust Co. — seeing profits dip from the year prior, with AMG and Flatirons continuing to post strong ROA.

Overall, only 12 of 48 banking institutions active in the region recorded lower profits in the just-completed year. (Data for Wells Fargo, JPMorgan Chase, Bank of America, Vectra Bank and Keybank for Dec. 31 are not yet available.)

State Banking Commissioner Chris Myklebust said lower profits could be the new normal for banks that are struggling with higher costs because of a more-stringent federal regulatory environment, as well as higher health-insurance premiums for employees.

“What I hear from banks is that the cost of compliance continues to go up, which raises their operating costs,” Myklebust said. “Health-insurance costs have also gone up.”

Banks in the Boulder Valley and Northern Colorado also bear higher costs for some office locations, and competition for workers, which also can drive up costs.

Still, Myklebust said that most state-chartered banks are profitable.

“We’re in what I would consider pretty good times, pretty steady times,” he said, noting the region’s strong housing market and increasing population.

But he cautions that banks recording lower-than-desired profits, reflected in ROA below the industry benchmark, could find themselves in trouble if the economy sours.

“Metrics haven’t changed,” he said. “If the earnings and the profitability look like this during good times … these costs are not going to go away when things get more difficult in the economy.”

Nationally, banking analysts have expressed concern about the impact on the banking sector if energy prices remain low. Oil priced at $30 a barrel has put significant strain on energy companies, and some banks are heavily leveraged in that sector.

Additionally, prices for agricultural commodities are low, potentially putting strain on farmers, agribusinesses and the banks that loaned to them.

But in Colorado, Myklebust said, banks have diversified so that risk is mitigated.

“We’ve been in a lower and declining cycle with commodities, both in energy and in ag,” he said. “Banks have been really well diversified in their portfolio. By no stretch of the imagination are we going to have the issues that we had in the ’80s.

“I think that the diversification is going to help the banks in the long run.”

Pat O’Brien, Boulder market president for Guaranty Bank and Trust Co., agreed that the cost of compliance, health insurance, labor and real estate are factors in restraining bank profits. But he said banks also must have the right, talented team in place to develop and market a bank’s products and services, thereby driving revenue and profits.

Additionally, banks must have the right menu of product offerings to create those revenue streams.

“It’s a tool that can differentiate the banks from peak performers to more moderate performers,” he said.

Larry Martin, chairman of Golden-based Bank Strategies LLC, a bank-consulting firm, said competition also is a factor that restrains bank profits.

“It’s probably a buyer’s market,” in terms of competition for business loans, he said, with some bankers offering longer terms at lower fixed interest rates.

Additionally, such low interest rates have compressed bank margins.

Martin agreed that the cost of compliance is a major factor in lower bank earnings. Dodd-Frank, the Bank Secrecy Act and the Patriot Act all place enormous reporting requirements on banks, enough that a job formerly held by one person must now be performed by two or three.

In the end, banks in the Boulder Valley, Northern Colorado and beyond will continue to face challenges in achieving the desired profitability benchmark.

“The industry norm of 1 percent … I think that was prior to 2008, when we had that significant downturn in the economy,” Martin said, noting that the industry has come a long way from those desperate times.

“Banks have been coming back,” he said. “The fact that we have banks that are profitable at all is good.”

Christopher Wood can be reached at 303-630-1942, 970-232-3133 or cwood@bizwestmedia.com.

It was hard to tell what was causing Verus Bank of Commerce chief executive Gerard Nalezny to lose his breath: the stunning powder he was experiencing during a recent ski trip in the mountains — from which he took a break for a telephone interview — or his bank’s latest financial numbers.

Fort Collins-based Verus indeed posted some breathtaking numbers at year-end 2015: a record $5.75 million net profit, a 2.1 percent return on assets (ROA) and a 17.69 percent return on equity. The latter two, the bank notes in a statement, are “both in line with…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!