Wells: Is Northern Colorado seeing shifts in Real Estate inventory like other parts of the country?

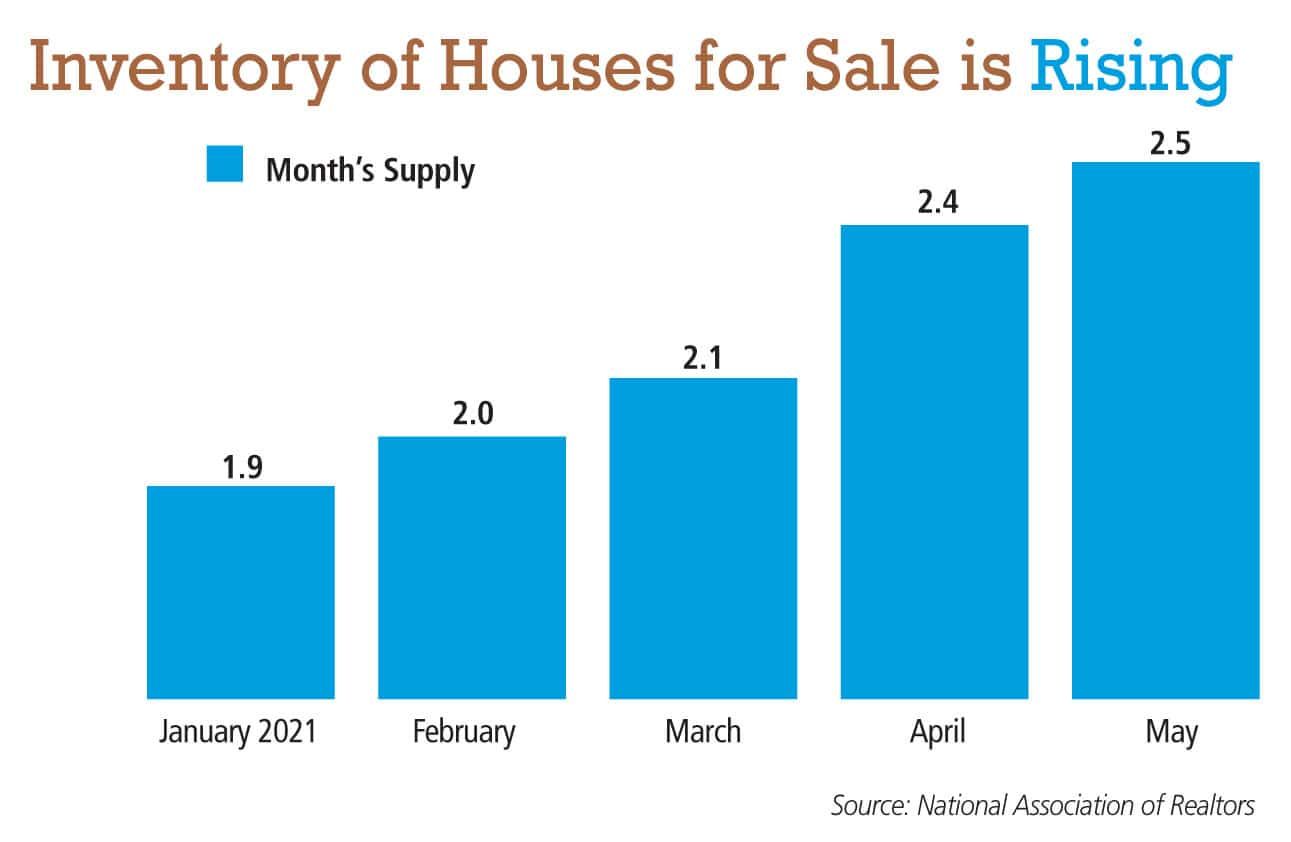

Looking at recent headlines, there are indications that many housing markets around the country are starting to see an uptick in housing supply. Nationally, inventory totals have been rising steadily since January, reaching 2.5 months of supply for single-family homes by the end of May (see graphic).

While this figure still represents a market that leans heavily in favor of sellers (traditionally, a “balanced” market falls somewhere around 4-7 months of available inventory), the trend is causing Realtors to ask about market conditions in Northern Colorado. Are there signs of a similar supply shift in our local communities?

Inventory, or housing supply, has been the buzz word across real estate since 2019, as we’ve witnessed dramatic drops in the availability of homes for sale. In many local markets, the number of homes for sale has declined around 60%-70%. In Larimer County, for instance, year-over-year availability dropped 62% from June 2020 to June 2021 — from 1,319 available homes to 501! For Weld County, supply is down 59.3% in the same period, from 1,074 available homes to 437.

SPONSORED CONTENT

Federal District Court Rules Corporate Transparency Act Unconstitutional . . . But Most Small Businesses Must Still Comply

Lyons Gaddis Real Estate and Business Attorney Cameron Grant shares important details of the Corporate Transparency Act (CTA).

The logical question: How is it that closed sales are up 5.5% (856 vs. 903) in Larimer County, from June 2020 to June 2021, when supply is that much tighter? Similarly, Weld County has also registered an increase in closed sales of 1.9% (788 vs. 803) over the same 12-month period.

The answer: The velocity of the marketplace has left us with no “standing inventory,” which is what many home buyers have long been used to — in other words, an available assortment of properties to browse through before finding the right one. All our local markets have experienced unprecedented demand, which has made the market feel as though there is nothing to buy. Inventory just doesn’t stand on the market.

Realtors in our area are, in fact, witnessing that homes are spending slightly more time on the market, and the volume of available homes for sale is making small gains. But the data for months of supply in Northern Colorado does not reflect any uniformity that could cause us to see a trend in the making. Local markets that have experienced a slight month-over-month uptick in months of supply are Estes Park, Johnstown, Loveland, Mead, and Wellington. Markets such as Severance and Timnath have actually decreased. The other regional markets have remained consistent in month-over-month analysis.

Sale price-to-list price (% comparison)

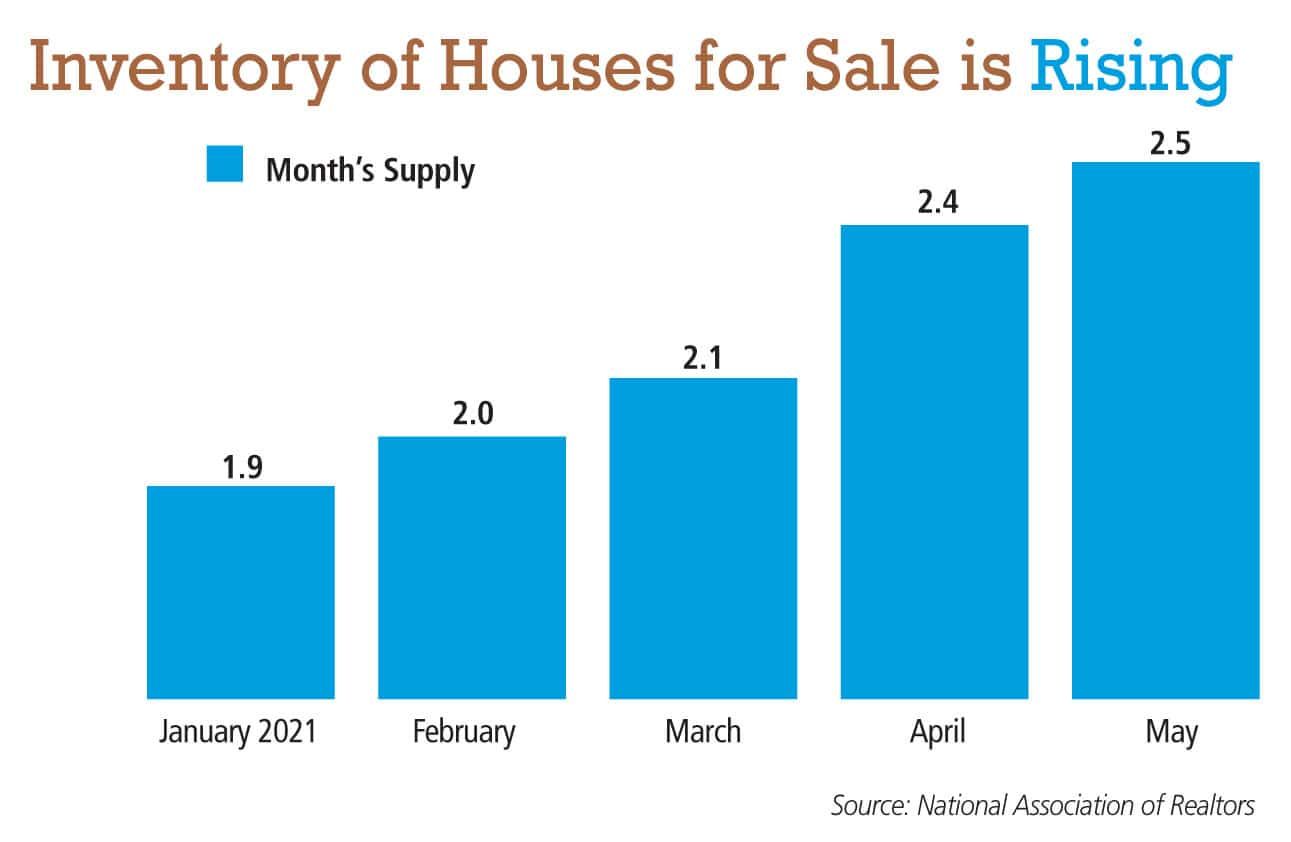

Competitiveness among buyers in our local markets has eased in some communities, but the necessity to pay over list price is still a very common occurrence here, with all local markets showing sale price-to-list price averages above 100% (See chart). Local Realtors have also witnessed a reduction in the “feeding frenzy” environment, where sellers are receiving multiple offers — but they still exist. Markets such Berthoud, Estes Park, Fort Collins, Greeley/Evans, and Johnstown have all seen increases to the average sale price-to-list price ratio. While Longmont, Loveland, Mead, Milliken, Severance, Timnath, Wellington, and Windsor all show some reductions in the ratio, and hopefully some relief for frustrated buyers.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.