Housing market winds its way back to a normal

To quote a recent Fortune.com article, it’s been a “remarkable” run for the American economy. At 110 months of growth since the end of the last recession, we’re experiencing the second-longest economic expansion on record. And in Northern Colorado, like much of the country, we’ve watched home prices climb right along with it.

To quote a recent Fortune.com article, it’s been a “remarkable” run for the American economy. At 110 months of growth since the end of the last recession, we’re experiencing the second-longest economic expansion on record. And in Northern Colorado, like much of the country, we’ve watched home prices climb right along with it.

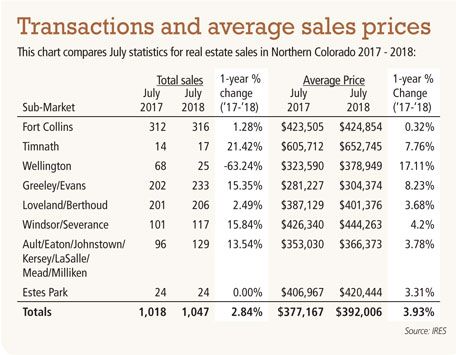

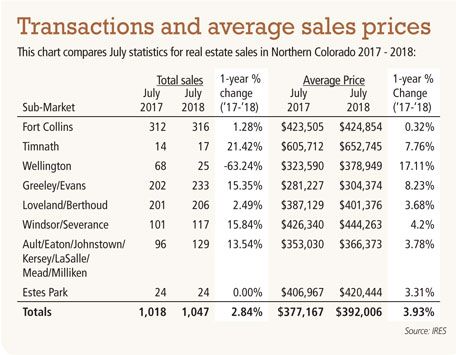

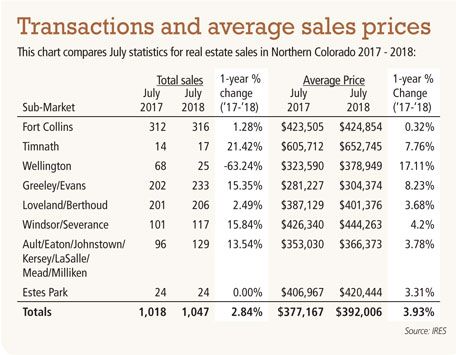

Now there are signs that both the economy and home prices may soon moderate. As Fortune points out, the pace of job growth is slowing, and inflation and interest rates are inching up. And the impact of last year’s federal income tax cut will begin to fade away. Locally, we can point to the fact that average June sales prices across the region were up 4.6 percent, followed by 3.9 percent for July. A year ago? June prices soared 11.1 percent and July jumped by 8.9 percent.

In other words, we’re beginning to see a return to stabilization in the housing market. What’s that mean if you expect to be a seller or buyer in the coming months?

SPONSORED CONTENT

Federal District Court Rules Corporate Transparency Act Unconstitutional . . . But Most Small Businesses Must Still Comply

Lyons Gaddis Real Estate and Business Attorney Cameron Grant shares important details of the Corporate Transparency Act (CTA).

Above all, pricing takes center stage. Sellers who could optimistically set lofty list prices are beginning to temper their expectations, both locally and around the country. For instance, Zillow reported at least one price reduction on 14.2 percent of all its listings during June, up from 13.4 percent the year before. And Zillow’s chief economist thinks price cuts could be even more common.

In addition to more price reductions, we see fewer cases of sellers receiving multiple offers on their homes. Listings will spend more time on the market, and overall housing inventory — which has been scant in Northern Colorado — will begin to grow slowly.

Which brings us back to the earlier statement about pricing. In this approaching-normal market, sellers will need to be more competitive with their pricing, while buyers in certain segments of the market will have more inventory options.

We may have forgotten after nine years of growth, but this is what normal looks like in the Northern Colorado housing market. While some may wonder if it’s a recession, we see it as a welcome adjustment toward stabilization — and a perhaps the opportunity for our market to catch up to the decade-long shortage of new home construction.

As we see prices ease overall, here are some noteworthy statistics that reflect what’s happening in the communities that make up Northern Colorado’s regional housing market:

• Average prices for the Greeley/Evans sub-market, which topped $300,000 in June for the first time, grew the most in July. July’s average price increased 8.23 percent to $304,374.

• Fort Collins prices were essentially flat in July over July 2017, up by 0.32 percent.

• After experiencing average price decline of 5.46 percent in June, average prices for Windsor/Severance ticked up by 4.2 percent.

• Housing inventory for the region totaled 1,704, similar to the 1,705 homes listed in June but still a healthy increase (13.7 percent) over the 1,499 homes on the market in May.

• Weld County sub-markets (Greeley/Evans, Windsor/Severance, and the combined smaller communities (Ault/Eaton/Johnstown/Kersey/LaSalle/Mead/Milliken) all experienced double-digit growth in the number of sales compared to July 2017. At the same time Larimer County sub-markets saw either a decline in sales or only minimal growth.

Brandon Wells is president of The Group Inc. Real Estate

To quote a recent Fortune.com article, it’s been a “remarkable” run for the American economy. At 110 months of growth since the end of the last recession, we’re experiencing the second-longest economic expansion on record. And in Northern Colorado, like much of the country, we’ve watched home prices climb right along with it.

To quote a recent Fortune.com article, it’s been a “remarkable” run for the American economy. At 110 months of growth since the end of the last recession, we’re experiencing the second-longest economic expansion on record. And in Northern Colorado, like much of the country, we’ve watched home prices climb right along with it.

Now there are signs that both the economy and home prices may soon moderate. As Fortune points out, the pace of job growth is slowing, and inflation and interest rates are inching up. And the impact…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!